AT A GLANCE

Transaction monitoring systems help banks detect suspicious activity like money laundering and fraud, but many financial institutions struggle with outdated systems, excessive false positives, fragmented customer data, compliance culture issues, and conflicting regulatory requirements. This guide reveals the five most common pitfalls that lead to regulatory fines and explains how to build an effective transaction monitoring program that actually works.

What Is Transaction Monitoring in Banking?

Transaction monitoring is the continuous process of reviewing customer transactions including transfers, deposits, withdrawals, and payments to detect suspicious activity that may indicate money laundering, terrorism financing, fraud, or other financial crimes.

This process is a fundamental requirement under the Bank Secrecy Act and similar anti-money laundering (AML) regulations worldwide. Financial institutions must implement transaction monitoring programs that can identify red flags in real-time or near real-time, generate alerts for investigation, and report suspicious activity to regulators through Suspicious Activity Reports (SARs).

Modern transaction monitoring typically combines automated systems that flag unusual patterns with human analysts who investigate alerts and make final determinations about whether activity is truly suspicious.

Why Do Financial Institutions Need Transaction Monitoring Systems?

Financial institutions need transaction monitoring systems because manual review of transactions is impossible at scale, regulatory compliance requires documented suspicious activity detection, and effective monitoring protects both the institution and society from financial crime.

The volume of electronic transactions has exploded with digital payments, making manual monitoring completely unfeasible. A mid-sized bank might process hundreds of thousands of transactions daily. Without automated systems, suspicious patterns would go undetected, exposing the institution to regulatory penalties and reputational damage.

Regulatory requirements demand proof of effectiveness. Authorities need evidence that your system regularly identifies suspicious transactions and generates appropriate SARs. According to FATF guidelines, transaction monitoring is a core component of any AML compliance program. Regulators conduct audits to verify that your monitoring systems actually work, not just that they exist.

The business case is clear: Transaction monitoring helps demonstrate program effectiveness to auditors, regulators, and stakeholders while protecting your institution from being used as a conduit for criminal activity.

What Happens When Transaction Monitoring Systems Fail?

When transaction monitoring systems fail, financial institutions face massive regulatory fines, reputational damage, and potential criminal liability for facilitating money laundering or terrorist financing.

Real-World Examples of Transaction Monitoring Failures

Danske Bank: €1,820,000 Fine

The Central Bank of Ireland recently fined Danske Bank €1,820,000 ****for three breaches of the Criminal Justice (Money Laundering and Terrorist Financing) Act 2010. The most serious violation: failing to monitor transactions for specific customer categories at its Irish branch for nearly nine years (2010-2019).

The root cause was historic data filters in Danske's automated transaction monitoring system, first implemented in 2005 and rolled out to Ireland in 2006. When Ireland's money laundering law came into effect in 2010, Danske never evaluated whether these old filters still worked or updated the system to meet new requirements.

This oversight led to complete monitoring gaps for some customer segments, including customers Danske itself had classified as high or medium risk. The bank essentially had blind spots in its monitoring system for nearly a decade.

HSBC: £64 Million Fine

The Financial Conduct Authority (FCA) fined HSBC £64 million because its automated transaction monitoring systems had "serious weaknesses" for eight years starting in March 2010.

The bank failed in three critical areas:

- Inappropriate scenarios: The system's rules for identifying money laundering or terrorist financing indicators weren't fit for purpose

- No testing or updates: Systems went years without proper testing or calibration

- Poor data quality: The data entering the system was inaccurate and incomplete

These failures meant HSBC's transaction monitoring system was essentially ineffective at detecting the very crimes it was designed to catch, including money laundering, terrorist financing, and suspicious remittances activity.

What Are the 5 Most Common Pitfalls in Transaction Monitoring?

1. How Does Fragmented Customer Data Undermine Transaction Monitoring?

Fragmented customer data creates investigation delays, increases false positive rates, and exposes institutions to regulatory criticism when analysts can't access complete, accurate customer information during alert reviews.

When an alert fires, investigators need immediate access to all relevant customer information to quickly identify the relevant information. If that data is scattered across multiple systems, outdated, or contradictory, several problems emerge:

Regulatory red flags appear immediately. Regulators view it as a major compliance failure when your organization has the necessary consumer data to make informed decisions but uses outdated information or worse, can't locate it at all during investigations.

Investigation times increase dramatically. Analysts waste hours searching through multiple files, systems, and teams to piece together customer profiles. This creates uncertainty and frustration, leading to poor-quality investigations and potentially missed suspicious activity.

For financial institutions, brokerages and trusts, establishing a clear primary source of truth is essential, something you can access quickly, trust completely, and depend on for accurate results. Without this single source of truth, your monitoring program operates with one hand tied behind its back.

TIP: Implement a centralized customer data platform that aggregates information from all systems and provides real-time access to investigators. This dramatically reduces alert resolution time and improves investigation quality.

2. Why Is "Box-Ticking" Culture Dangerous for Transaction Monitoring?

A box-ticking compliance culture treats transaction monitoring as a regulatory checkbox rather than a crime prevention tool, leading to disengaged teams, superficial investigations, and ultimately ineffective fraud and money laundering detection.

Compliance can feel like a check-box activity rather than a proactive, empowered function within an organization. But transaction monitoring is fundamental to combating financial crime. Good financial crime prevention can literally save lives by directly preventing terrorism financing and money laundering.

Preventing illegal activity should be the primary motivator for transaction monitoring teams, but this sense of purpose easily disappears when governance structures emphasize compliance documentation over actual crime prevention.

Employees need to understand how their work impacts society and the economy. When transaction monitoring becomes purely procedural reviewing alerts just to close them, not to actually investigate suspicious behavior the entire program loses effectiveness.

The symptoms of box-ticking culture include:

- Investigators focusing on closing alerts quickly rather than thoroughly

- Minimal use of available data sources during investigations

- Reluctance to escalate suspicious activity for fear of creating more work

- High alert closure rates with few SARs filed (potential under-reporting)

- No feedback loop between monitoring results and risk assessments

Organizations with strong compliance cultures empower their teams to take time on complex cases, reward thorough investigations, and celebrate when suspicious activity is successfully detected and reported, not just when alert queues are cleared.

TIP: Hold regular training sessions that highlight real case studies showing how transaction monitoring prevented actual financial crimes. Connect daily work to meaningful outcomes.

3. Why Do Off-the-Shelf Transaction Monitoring Systems Often Fail?

Off-the-shelf transaction monitoring systems fail because they're not calibrated to your institution's specific risk profile, customer base, or transaction patterns, resulting in excessive false positives, missed suspicious activity, and wasted resources.

When transaction monitoring became a regulatory requirement, many organizations rushed to purchase generic, off-the-shelf systems just to check the compliance box. At the time, many didn't understand the consequences of having an unsuitable system that isn't tuned to their unique risks.

The early days of transaction monitoring were chaotic even regulators disagreed on what type of system was required. Off-the-shelf solutions provided a quick fix, but they've proven to be resource black holes that cost far more in the long run than anticipated.

The core problems with generic systems:

Generic scenarios don't match your risk profile. A system designed for large multinational banks will generate irrelevant alerts at a regional credit union. A system configured for retail banking won't catch the suspicious patterns typical in private banking or wealth management.

Limited customization capabilities. Many off-the-shelf solutions resist modification or require extensive (expensive) vendor involvement to adjust rules, thresholds, or scenarios. As your business evolves or new threats emerge, the system can't adapt quickly.

Poor integration with existing systems. Generic solutions often struggle to integrate smoothly with your core banking systems, customer databases, and other compliance tools, creating data quality issues and operational friction.

One-size-fits-all thresholds. Default alert thresholds might be appropriate for some institutions but completely wrong for yours, leading to either alert overload or dangerous monitoring gaps.

The FCA and other regulators have made it clear: financial institutions must understand what their automated transaction monitoring systems can and cannot do, and ensure those systems are appropriate for their specific circumstances.

TIP: If you're using an off-the-shelf system, conduct a thorough gap analysis comparing the system's capabilities to your institution's actual risk profile. Document where the system falls short and implement compensating controls or plan for system replacement.

4. How Do False Positives Destroy Transaction Monitoring Efficiency?

False positives overwhelm transaction monitoring teams with unnecessary alerts, waste investigative resources on legitimate activity, and prevent analysts from focusing on genuine threats creating both compliance risks and unsustainable workloads.

As financial institutions expand, alert volumes grow exponentially. Without proper calibration, this quickly becomes unmanageable. Any sustainable operation must ensure workloads remain reasonable and resources can be targeted based on risk.

The false positive problem is the most frustrating aspect of transaction monitoring for most teams. Analysts spend hours investigating alerts that turn out to be completely legitimate business activity: a birthday gift, a home purchase, a business expense. Every hour spent on false positives is an hour not spent investigating real financial crime.

The cascade effects of high false positive rates:

Resource drain: Large institutions might review tens of thousands of false positives monthly. Each requires analyst time, documentation, and formal closure. The labor costs are staggering.

Alert fatigue: When analysts spend all day clearing obvious false positives, they become desensitized. This increases the risk that genuine suspicious activity gets insufficient scrutiny because it's buried in noise.

Slower response times: High false positive rates create alert backlogs. Even when a genuine suspicious transaction generates an alert, it might sit in a queue for days or weeks before review.

Customer friction: Some systems generate customer-facing holds or delays while investigating alerts. False positives create poor customer experiences when legitimate transactions are unnecessarily flagged.

Improving your operation's efficiency by reducing false positives should be a top priority. Industry benchmarks suggest false positive rates between 95-98%, meaning only 2-5% of alerts represent actual suspicious activity. Top-performing institutions drive this closer to 10-20% through better tuning.

TIP: Conduct quarterly scenario tuning exercises where you analyze closed alerts to identify patterns in false positives. Adjust thresholds and rules to eliminate the most common false positive triggers while maintaining detection effectiveness.

5. How Do Conflicting Regulatory Approaches Complicate Transaction Monitoring?

Conflicting regulatory approaches across different jurisdictions create compliance complexity because what one regulator considers acceptable transaction monitoring practice, another may reject forcing institutions to implement multiple approaches or risk violations.

The fact that different regulators have different perspectives on what's permissible in transaction monitoring significantly increases compliance challenges, especially for institutions operating across multiple jurisdictions.

A common example: system-generated alert treatment

Consider calibration error alerts. Regulator A might say: "If these alerts are caused by a calibration error, there's no need to review them, just fix the calibration and move on." Meanwhile, Regulator B insists: "All alerts must be reviewed regardless of how they originated, including those from known system errors."

Both positions have logical foundations, but they're mutually exclusive. An institution operating in both jurisdictions must either:

- Maintain separate monitoring programs with different standards (complex and expensive)

- Apply the strictest standard everywhere (resource-intensive but safer)

- Document detailed justifications for jurisdiction-specific approaches (requires sophisticated compliance infrastructure)

Other areas where regulatory approaches diverge:

Lookback periods: How far back must you review when updating scenarios or discovering system failures? Requirements vary from 90 days to several years.

Risk-based monitoring: Some regulators fully embrace risk-based approaches where low-risk customers receive less intensive monitoring. Others expect uniform monitoring regardless of risk classification.

Technology requirements: Certain jurisdictions mandate specific system capabilities or certifications. Others remain technology-neutral, focusing on outcomes rather than methods.

Reporting thresholds: What triggers a mandatory suspicious activity report varies significantly across jurisdictions, creating challenges for institutions with cross-border customers.

The bottom line: understanding your specific regulatory requirements is critical. You can't implement effective transaction monitoring without knowing exactly what each applicable regulator expects from your program.

TIP: Create a regulatory requirements matrix that maps each jurisdiction where you operate to specific transaction monitoring expectations. Update this quarterly and use it to guide system configuration and procedure development.

How Should Banks Balance Automated and Manual Transaction Monitoring?

Banks should combine automated systems for scalable pattern detection with human expertise for complex investigation and judgment calls, creating a hybrid approach where technology handles volume and humans handle nuance.

The law typically doesn't prescribe specific transaction monitoring approaches, giving financial institutions flexibility in strategy. However, this freedom creates a challenge: finding the right balance.

A purely human approach uses extensive resources and lacks the flexibility to adapt quickly to specific risks. Manually reviewing millions of transactions is simply impossible.

Fully automated systems can be expensive to implement and maintain, and they lack human judgment for complex cases. No algorithm can perfectly replicate an experienced investigator's intuition about suspicious behavior.

What Do Regulators Say About Transaction Monitoring Technology?

The FCA's Financial Crime Guide points to best practices, urging financial institutions to consider how they "feed findings from monitoring back into the customer's risk profile" and stressing the importance of understanding "what automated transaction monitoring systems can do and what they can't do."

In 2018, the Monetary Authority of Singapore (MAS) released a report by the AML/CFT Industry Partnership (ACIP) emphasizing the importance of following legal and regulatory standards, particularly regarding data privacy when implementing monitoring analytics.

Key principle: Legal and regulatory standards constantly evolve and become stricter. Financial institutions must fully understand applicable regulatory requirements before launching any analytics operations. If obvious gaps exist between regulatory requirements and proposed models, institutions must modify their approach to achieve compliance.

Data privacy and protection laws are equally critical; they govern the collection, disclosure, and use of data, especially personal data, in jurisdictions where institutions operate or maintain clients.

When Do You Need Human Involvement in Transaction Monitoring?

Even the most efficient automated transaction monitoring system requires human expertise for:

1. Scoping and documentation: Defining what transaction monitoring should cover, including evaluation of supplementary data sources (such as IP addresses, device fingerprints, or geolocation data).

2. System tuning and rule adjustments: Many "off-the-shelf" solutions lack flexibility or require significant time and resources to modify for new risks. Human experts must continuously evaluate and adjust monitoring rules.

3. Alert investigation: Reviewing potential issues identified by systems, which may relate to fraud, money laundering, sanctions violations, or other financial crimes. Human judgment is essential for distinguishing between unusual-but-legitimate activity and genuine red flags.

4. Regulatory compliance and reporting: Filing suspicious activity reports, observing data privacy laws, preventing data breaches, and defending against cyberattacks all require human oversight.

5. Management reporting and assurance: Based on scope and complexity, providing reports to senior management and regulators, and conducting quality assurance require human analysis and communication.

Each organization must determine and document the optimal way to monitor transactions for its specific business model and risk profile. The prevention of financial crime depends heavily on culture, education, and training, not just technology.

TIP: Establish clear escalation criteria that define when automated decisions are sufficient versus when human review is mandatory. Document these criteria and train staff accordingly.

What Are Effective Transaction Monitoring Scenarios and Rules?

Effective transaction monitoring scenarios are specific patterns or behaviors that indicate potential financial crime risk, calibrated to your institution's customer base, products, and geographic footprint to generate meaningful alerts rather than noise.

Transaction monitoring scenarios typically focus on detecting behaviors such as:

Common AML Transaction Monitoring Scenarios

Structuring (Smurfing): Multiple transactions just below reporting thresholds designed to avoid regulatory reporting requirements. For example, a customer makes fifteen $9,000 deposits over two weeks when the reporting threshold is $10,000.

Rapid movement of funds: Money enters an account and immediately transfers out, suggesting the account is being used as a pass-through for layering illegitimate funds.

Dormant account reactivation: An account with no activity for months or years suddenly receives large deposits and transfers, potentially indicating the account has been compromised or sold.

High transaction velocity: An unusual spike in transaction frequency compared to the customer's historical baseline, especially when accompanied by unusually large amounts.

Round dollar amounts: Frequent transactions in exact round numbers (e.g., $50,000, $100,000) which can indicate artificial transactions rather than legitimate business activity.

Geographic risk patterns: Transactions involving high-risk jurisdictions known for money laundering, terrorism financing, or weak AML enforcement.

Inconsistent with customer profile: A retail customer suddenly conducting wholesale business transactions, or a local small business receiving wires from multiple foreign countries.

What Makes a Good Transaction Monitoring Rule?

Effective rules are:

- Risk-based: Calibrated differently for different customer risk tiers

- Data-driven: Thresholds based on actual statistical analysis of your customer population, not arbitrary numbers

- Regularly tuned: Reviewed and adjusted quarterly or semi-annually based on alert outcomes

- Documented: Complete documentation explaining the rationale, thresholds, and expected alert volumes

- Tested: Validated using historical data to ensure they catch known suspicious cases without excessive false positives

TIP: Start with industry-standard scenarios but customize them for your institution. A cash-intensive business in one region might have completely different "normal" patterns than tech companies in another region. Generic rules will fail.

How Can Financial Institutions Implement Effective Transaction Monitoring?

Financial institutions can implement effective transaction monitoring by conducting a thorough risk assessment, selecting appropriate technology, customizing scenarios to their specific risks, training investigators properly, and continuously tuning the system based on outcomes.

Step-by-Step Implementation Framework

1. Conduct Comprehensive Risk Assessment Understand your institution's specific money laundering and terrorism financing risks based on customers, products, geographies, and delivery channels. This assessment drives everything else.

2. Define Clear Objectives and Scope Document what your monitoring program should detect, which customer segments require monitoring, and what constitutes suspicious activity for your institution.

3. Select or Configure Appropriate Technology Choose systems that can be customized to your risk profile. Prioritize flexibility, data integration capabilities, and reporting features over brand names.

4. Develop Risk-Based Scenarios Create monitoring rules that reflect your actual risks. Different customer segments may need completely different scenarios.

5. Establish Governance and Oversight Define roles, responsibilities, escalation procedures, and quality assurance processes. Senior management must understand how the program operates and its effectiveness.

6. Train Investigators Thoroughly Provide comprehensive training on financial crime typologies, investigation techniques, regulatory requirements, and your specific systems and procedures.

7. Implement Continuous Tuning Process Establish quarterly reviews of alert outcomes, false positive rates, and scenario effectiveness. Adjust thresholds and rules based on results.

8. Create Feedback Loops Ensure findings from transaction monitoring inform customer risk scoring, onboarding decisions, and broader AML program improvements.

TIP: Don't try to implement everything at once. Start with core scenarios covering your highest risks, validate they work properly, then gradually add more sophisticated monitoring capabilities.

Frequently Asked Questions About Transaction Monitoring

What is the difference between transaction monitoring and transaction screening?

Transaction screening checks individual transactions in real-time against sanctions lists, watchlists, and prohibited parties before processing, while transaction monitoring reviews patterns of completed transactions over time to detect suspicious behavior like money laundering or fraud. Screening is preventive (stops bad transactions before they happen), while monitoring is detective (identifies problematic patterns after transactions occur).

How often should transaction monitoring scenarios be reviewed and updated?

Transaction monitoring scenarios should be reviewed quarterly at minimum, with formal scenario tuning exercises conducted semi-annually or annually. However, scenarios must also be updated immediately when new money laundering typologies emerge, regulations change, your customer base shifts significantly, or system performance issues arise. Leading institutions review their top-generating scenarios monthly to optimize false positive rates.

What is considered a high false positive rate in transaction monitoring?

Industry averages for false positive rates range from 95-98%, meaning only 2-5% of alerts represent actual suspicious activity. However, best-in-class institutions achieve false positive rates of 80-90% through careful tuning and risk-based approaches. Any rate above 98% suggests serious calibration problems that waste resources and create compliance risks through delayed legitimate alert investigation.

Can small financial institutions afford effective transaction monitoring systems?

Yes, small financial institutions can implement effective transaction monitoring through cloud-based solutions, vendor-provided monitoring services, or consortium approaches where multiple small institutions share monitoring infrastructure. The key is selecting technology and approaches scaled to your transaction volumes and risk profile rather than implementing enterprise-level systems designed for money center banks. Regulators expect proportional, risk-based monitoring not identical capabilities regardless of size.

What data privacy considerations apply to transaction monitoring?

Transaction monitoring must comply with data privacy laws like GDPR, CCPA, and local regulations governing personal data collection and use. Key considerations include: limiting data collection to what's necessary for AML compliance, securing monitoring data appropriately, establishing retention periods that balance regulatory requirements with privacy principles, and ensuring customers' privacy rights (like data access requests) don't compromise legitimate AML investigations. Always consult legal counsel when implementing monitoring across jurisdictions.

How do you measure transaction monitoring effectiveness?

Transaction monitoring effectiveness is measured through multiple metrics: SAR filing rates compared to risk profile expectations, alert-to-SAR conversion rates, scenario coverage of known typologies, false positive rates, average alert resolution time, regulatory exam findings, quality assurance scores on investigation files, and comparison of your SARs to law enforcement outcomes when feedback is available. No single metric tells the complete story. You need a balanced scorecard approach.

What is the role of machine learning in modern transaction monitoring?

Machine learning enhances traditional rules-based transaction monitoring by identifying complex patterns that rule-based systems miss, reducing false positives through more sophisticated customer behavior modeling, adapting to new money laundering techniques automatically, and processing larger data volumes more efficiently. However, machine learning doesn't replace human judgment; it augments existing systems by providing better alerts for human investigators to review. Explainability remains critical for regulatory acceptance.

Do all customer types require the same level of transaction monitoring?

No, risk-based transaction monitoring applies different levels of scrutiny based on customer risk ratings. High-risk customers (PEPs, cash-intensive businesses, customers in high-risk jurisdictions) typically face more intensive monitoring with lower thresholds and more scenarios. Low-risk customers (established retail customers, regulated entities) may have less intensive monitoring with higher thresholds. However, all customers require some level of monitoring; you cannot exempt any customer segment entirely from your monitoring program.

Key Takeaways: Building an Effective Transaction Monitoring Program

Centralize customer data into a single source of truth that investigators can access instantly. Fragmented data destroys investigation quality and creates regulatory risk.

Foster a crime prevention culture rather than a box-checking mentality. Help your team understand how their work prevents real financial crimes and protects society.

Customize your monitoring system to your institution's specific risk profile. Off-the-shelf systems require significant tuning to become effective.

Attack false positives aggressively through regular scenario tuning, risk-based thresholds, and continuous optimization. High false positive rates waste resources and create alert fatigue.

Understand your regulatory landscape completely, especially if operating across multiple jurisdictions. Document how you meet each regulator's specific expectations.

Balance technology with human judgment by using automation for pattern detection and scalability while preserving human expertise for complex investigations and decision-making.

Tune continuously based on alert outcomes, typology changes, and business evolution. Transaction monitoring is never "set and forget."

Invest in training so investigators understand not just your systems and procedures, but also financial crime typologies, investigation techniques, and the "why" behind the work.

How Flagright Helps Financial Institutions Implement Effective Transaction Monitoring

Flagright is rapidly becoming a one-stop solution to combat financial crime, with robust systems designed to help financial institutions manage risk, comply with regulations, and improve customer experience. Flagright provides the technology and expertise needed to avoid common transaction monitoring pitfalls and implement truly effective programs.

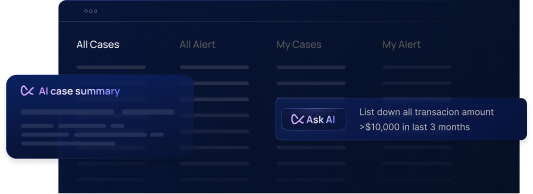

Case Management

Flagright offers an AML case management feature that enables independent investigation of each case, assigns priority actions, facilitates case assignment to colleagues, and provides real-time Slack alerts for urgent situations. This solves the fragmented data problem by centralizing all investigation activities in one platform.

Rules Management

With Flagright's customizable transaction monitoring rules, you can track high transaction amounts, payment frequency, velocity, card counterparty count, and dormancy. The platform enables comprehensive oversight of customers, legal entities, end customers, and payment processors all within one powerful solution designed to detect suspicious activity and strengthen financial compliance. This flexibility eliminates the limitations of off-the-shelf systems.

Risk-Based Approach

Flagright's solution assists in easily configuring various types of scenarios that automatically monitor different customer segments against relevant scenarios, enabling more effective transaction monitoring. This helps organizations satisfy various compliance regulations while reducing false positives through intelligent segmentation.

Comprehensive Financial Crime Prevention

Because of evolving AML regulations over the years, transaction monitoring has changed to emphasize ongoing monitoring of customer relationships. Financial institutions have made enormous investments in response, yet authorities across multiple jurisdictions still penalize organizations that don't effectively implement transaction monitoring.

Flagright gives you everything needed to stop financial crime, including:

- Real-time transaction monitoring solutions

- Dynamic customer risk scoring

- KYC/KYB and ID verification

- Sanctions and crypto sanctions screening

- Bad actor database

- Automated fintech licensing application support

- Compliance across crypto and stablecoin activity

Contact us to schedule a free demo and see how Flagright can help your institution avoid common transaction monitoring pitfalls while building a truly effective AML compliance program.

.svg)