The Problem

NextPay's rapid growth in the Philippines' fintech scene was a double-edged sword. While their transaction volume showcased their success, it also made them a prime target for sophisticated fraudsters.

"Our growth brought both opportunities and challenges. We could detect only about 60% of fraudulent activities, which was alarming."

— Jules Arambulo, Risk and Compliance Manager at NextPay"

The challenge was clear: How could NextPay effectively convey the robustness of their platform and assure their users of its security?

"Our product's complexity meant that our team often struggled with real-time fraud detection, especially during peak transaction times. We needed a solution that was both dynamic and reliable."

Jules Arambulo, Risk and Compliance Manager at NextPay

The Solution

Enter Flagright. In just one week, NextPay had fully integrated Flagright's cutting-edge platform, a testament to its adaptability and efficiency.

"The swift integration process was a game-changer. It meant we could immediately address our challenges without any delay," Jules emphasized.

But the rapid integration was just the beginning. Flagright's platform offered:

- Real-time Fraud Prevention: The ability to block fraudulent transactions as they occurred, ensuring proactive action.

- Advanced Rule Engine and ML Algorithms: Drawing from global typologies, these tools provided a formidable defense against fraud, allowing for swift testing, insights, and adaptation.

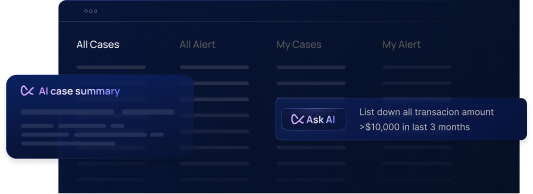

- Centralized Case Management: Streamlining operations and enhancing efficiency with tools like entity linking and narrative co-pilot.

- Risk Scoring: Efficiently assessing and managing potential threats, moving away from traditional methods.

- Comprehensive Dashboarding: Offering a clear view of everything from team performance to system monitoring.

"Flagright's platform was intuitive and powerful. It transformed our approach to fraud detection, enabling us to act swiftly and decisively," Jules said.

The Results

The results of the NextPay and Flagright partnership were nothing short of transformative.

"In just a short span, we boosted our fraud detection rates to 95% and saw a 40% reduction in overall fraud incidents," Jules highlighted.

The benefits were clear:

- Teams had the tools they needed to work better and faster.

- They spent less time and money on fighting fraud.

- Users felt safer and trusted the platform more.

"For us, the impact of Flagright's platform was immediate. We could address fraud threats in real-time, enhancing user trust and platform reliability," Jules added.

Beyond the technical advantages, the support from Flagright stood out as a defining factor in the partnership's success. Jules praised, "Their customer support is the gold standard in the industry. They were always there to help, making sure we got the most out of their system.”

The collaboration also received positive feedback from NextPay's user base, with many highlighting the platform's enhanced security features.

"We've received more positive feedback than ever before. That initial impression, that trust we build with our users, it's invaluable," Jules concluded.

.svg)