Transaction monitoring is an essential aspect of compliance and fraud protection for fintechs and neobanks. It involves monitoring and analyzing financial transactions in real-time to detect and prevent fraudulent activities.

This can help fintechs and neobanks to comply with anti-money Laundering (AML) regulations, manage risks and protect their customers' financial information.

In this article, we will discuss the benefits of transaction monitoring and how Flagright's no-code centralized AML compliance and fraud protection platform can help fintechs and neobanks to improve their compliance and fraud protection efforts.

History of transaction monitoring

The history of transaction monitoring can be traced back to the early days of banking and finance. In the past, transaction monitoring was primarily focused on detecting and preventing fraudulent activities, such as check and credit card fraud. Banks and financial institutions would manually review transactions and flag any suspicious activities.

As technology advanced, transaction monitoring evolved to become more automated. In the 1980s and 1990s, financial institutions began to use computer systems to monitor transactions in real-time. This allowed them to detect fraudulent activities more quickly and accurately.

In the 2000s, transaction monitoring became even more sophisticated with the introduction of machine learning and artificial intelligence (AI) technologies. These technologies allowed financial institutions to analyze large amounts of data and identify patterns that indicate fraudulent activities.

In recent years, transaction monitoring has become increasingly important for compliance with anti-money laundering (AML) regulations.

Financial institutions are now required to monitor transactions to identify and report suspicious activities to the relevant authorities. This has led to the development of specialized transaction monitoring software and services that can help financial institutions to comply with AML regulations.

In the fintech and neobanking industry, transaction monitoring has become a crucial aspect to ensure compliance with regulations and to prevent money laundering and other fraudulent activities. Platforms like Flagright's no-code centralized AML compliance and fraud protection platform offers a comprehensive set of features that can help fintechs and neobanks to improve their compliance and fraud protection efforts.

The consequences of non-compliance with transaction monitoring regulations

Transaction monitoring is an essential aspect of compliance and fraud protection for financial institutions, including fintechs and neobanks. It involves monitoring and analyzing financial transactions in real-time to detect and prevent fraudulent activities, as well as comply with anti-money laundering (AML) regulations. However, failure to comply with transaction monitoring regulations can have serious consequences for financial institutions like fintechs and neobanks, including financial penalties and reputational damage.

Recent examples of companies that have faced penalties and fines due to breaches or failures in transaction monitoring include:

- In 2019, Deutsche Bank was fined $150 million by the New York Department of Financial Services for its inadequate transaction monitoring systems, which failed to detect and report suspicious activities related to money laundering and sanctions violations.

- In 2020, Standard Chartered Bank agreed to pay $1.1 billion to resolve investigations by the U.S. Department of Justice, the Federal Reserve, and the New York State Department of Financial Services into its AML compliance failures, including its inadequate transaction monitoring systems.

- In 2020, FinCEN (Financial Crimes Enforcement Network) fined US Bank $185 million for its AML compliance failures, including its inadequate transaction monitoring systems.

These examples demonstrate the serious consequences that financial institutions can face if they fail to comply with transaction monitoring regulations. The fines and penalties imposed by regulatory bodies can be substantial, and the reputational damage can be significant.

To avoid these consequences, it is important for fintechs and neobanks to implement effective transaction monitoring systems and procedures. This can include utilizing advanced technologies, such as machine learning and artificial intelligence (AI), to analyze large amounts of data and identify patterns that indicate suspicious activities. Additionally, it is important to have a robust compliance program in place and to conduct regular internal audits to ensure that the systems and procedures are functioning as intended.

By implementing effective transaction monitoring systems and procedures, fintechs, digital banks and neobanks can reduce the risk of costly breaches and ensure compliance with regulations. This helps them protect their customers’ financial information, prevent losses, and maintain a positive reputation in the industry.

Benefits of Transaction Monitoring

The benefits of implementing a robust transaction monitoring system are numerous, including:

1. Real-time fraud detection

One of the primary benefits of transaction monitoring is that it can help financial institutions and fintech companies to detect fraudulent activities in real-time. By monitoring and analyzing financial transactions, they can quickly identify and flag suspicious activities, which can prevent losses and protect customers' financial information.

2. Improved compliance with regulatory requirements

Financial institutions are required to comply with various regulations such as the Anti-Money Laundering (AML) and the Bank Secrecy Act (BSA) to prevent financial crimes. By implementing a transaction monitoring system, financial institutions can identify and report suspicious activities that may be in violation of these regulations.

3. Enhanced security for financial transactions

Transaction monitoring allows financial institutions to detect and stop fraudulent activities before they occur, thereby increasing the security of financial transactions.

4. Efficient risk management

Transaction monitoring can help financial institutions and fintech companies to identify and manage risks associated with their business operations. This can include identifying and mitigating risks associated with money laundering, terrorist financing, and other illegal activities.

5. Reduced costs associated with financial crimes

Fraudulent activities can result in significant financial losses for financial institutions. By implementing a transaction monitoring system, these losses can be minimized, and the costs associated with investigating and rectifying financial crimes can be reduced.

6. Improved overall efficiency in financial operations

A transaction monitoring system can automate many of the manual processes involved in identifying suspicious activities, reducing the need for human intervention and increasing overall efficiency in financial operations.

Conclusion

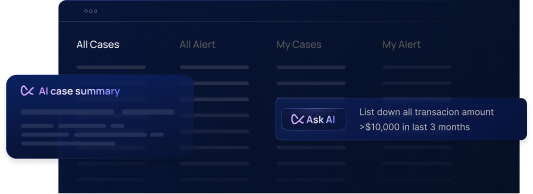

At Flagright, we understand the importance of transaction monitoring in the financial industry. That's why we offer the best solution for fintechs and neobanks with our real-time and risk-based transaction monitoring solution.

Our solutions go beyond transaction monitoring to include customer risk scoring and assessment, KYC and KYB orchestration, sanctions screening, blockchain analytics, fintech licensing, and advisory services.

These services are designed to help fintechs and neobanks stay compliant and secure, while also helping them streamline their operations, save costs, and grow their business.

Contact us here to schedule a free demo if you're a fintech or neobank and see how our solution can benefit your business.

.svg)