AML Compliance in the Fight Against Terrorist Financing

Terrorist financing is a growing concern in the financial industry, as these companies handle large amounts of financial transactions and have access to sensitive customer information.

Compliance with regulations aimed at preventing terrorist financing is crucial for fintech and neobank companies to maintain their reputation and avoid legal penalties.

However, it can be challenging to stay compliant while also keeping up with the fast-paced and ever-evolving nature of the financial industry.

In this article, we will explore the methods and history of terrorist financing, the challenges of detecting and preventing terrorist financing, AML compliance as a crucial tool, and how fintechs and neobanks can stay compliant in the fight against terrorist financing.

What is terrorist financing?

Terrorist financing refers to the collection and provision of funds, in any form, to support the planning, preparation, or execution of terrorist acts. It is the financial support that enables terrorist organizations to plan, carry out and continue their operations, which results in the loss of lives, properties, and destabilization of economies and societies.

Terrorist financing can take many forms, including the collection of donations, the sale of illicit goods, the use of front organizations, and the exploitation of the informal financial sector. It can also involve the use of new technologies and digital currencies, which can make it more difficult to detect and prevent.

Terrorist financing is a global threat, and it is not limited to any particular region or group. The funds raised by terrorist organizations can be used to purchase weapons, finance training and travel, and provide support to the families of terrorists.

Common methods of terrorist financing

Terrorist organizations use a variety of methods to raise funds for their operations. Some of the most common methods of terrorist financing include:

1. Charitable organizations and front companies

Terrorist organizations may establish or infiltrate legitimate charitable organizations and use them to raise funds. They may also use front companies to launder money and move it to support their operations. These organizations and companies may appear to be legitimate on the surface, but in reality, they are used to raise and move funds for terrorist activities.

2. Illicit activities

Terrorist organizations may engage in a variety of illicit activities to raise funds. These can include drug trafficking, human smuggling, extortion, and other criminal activities. These activities can generate significant amounts of money for terrorist organizations, and can also provide a way for them to move money across borders.

3. The use of new technologies and digital currencies

The proliferation of new technologies and digital currencies has made it easier for terrorist organizations to raise and move funds. These technologies and currencies can be used to facilitate anonymous transactions, making it more difficult for authorities to trace the money and identify the individuals involved.

4. Exploiting the informal financial sector

Terrorist organizations may also use informal financial systems, such as hawala, to move money. These systems are often based on trust and rely on networks of intermediaries to facilitate transactions. They can be difficult for authorities to regulate and monitor, making them an attractive option for terrorist organizations.

5. Fraudulent activities

Terrorist organizations may also engage in fraudulent activities such as credit card skimming, phishing, and money mule schemes to raise funds. They may use these methods to obtain personal and financial information from individuals and then use that information to make unauthorized transactions.

All of these methods are used to evade detection and to move money anonymously. It is challenging for governments, financial institutions, and other stakeholders to detect and prevent terrorist financing, as these terrorist organizations use multiple methods and constantly adapt to new technologies and financial systems.

To combat these methods, continued efforts by all stakeholders is needed to improve the surveillance, detection, and reporting of suspicious transactions and activities.

The history of terrorist financing

Terrorist financing has been a concern for governments and financial institutions for decades. The history of terrorist financing can be traced back to the 1970s and 1980s, when various terrorist groups began to use illicit means to fund their operations. One of the earliest examples of this was the use of drug trafficking by the Palestinian Liberation Organization (PLO) to fund their activities.

In the 1990s, the issue of terrorist financing came to the forefront of international attention following the bombing of the World Trade Center in 1993. This attack led to increased pressure on governments and financial institutions to take action to prevent terrorist financing.

In the wake of the 9/11 terrorist attacks, the U.S. government passed the USA PATRIOT Act in 2001, which included provisions aimed at combatting terrorist financing. This included the creation of the Financial Crimes Enforcement Network (FinCEN) to combat money laundering and the financing of terrorism.

In the years that followed, various international organizations and governments began to take action to combat terrorist financing. The United Nations adopted the International Convention for the Suppression of the Financing of Terrorism in 1999, which has been ratified by over 180 countries. The Financial Action Task Force on Money Laundering (FATF) was created in 1989 to develop and promote policies to combat money laundering and terrorist financing.

In recent years, the issue of terrorist financing has become increasingly complex due to the proliferation of new technologies and the rise of non-traditional financial institutions, such as fintech companies. As a result, governments and financial institutions have had to adapt their strategies to keep pace with these changes and continue to combat terrorist financing effectively.

Overall, the history of terrorist financing is a story of constant adaptation and evolution, as governments, financial institutions, and other actors have sought to combat this threat. The fight against terrorist financing is ongoing and requires continued efforts from all stakeholders to prevent the illicit financing of terrorist activities.

The challenges of detecting and preventing terrorist financing

Financial Institutions, including fintechs and neobanks are faced with a unique set of challenges when it comes to detecting and preventing terrorist financing.

One major challenge is the sheer volume of financial transactions that take place through financial platforms. With so many transactions happening in real-time, it can be difficult for businesses to keep up and effectively monitor for suspicious activity.

Another challenge is the lack of a centralized database or system for sharing information about terrorist financing. Financial institutions rely on a variety of different sources, such as government lists, to identify individuals and entities associated with terrorist financing. Without a centralized system, it can be difficult to ensure that all relevant information is being considered.

Additionally, financial institutions may also struggle with the complexity of compliance regulations. These regulations are constantly evolving and can vary depending on the jurisdiction in which a business operates. This can make it difficult for financial institutions to stay up-to-date on the latest requirements and ensure that they are in compliance.

The regulatory landscape surrounding terrorist financing is also constantly changing as new laws and regulations are introduced. This can make it difficult for fintechs and neobanks to stay compliant and avoid legal penalties.

Overall, detecting and preventing terrorist financing in the fintech and neobank industry requires a combination of advanced technology, a deep understanding of the regulatory landscape, and a commitment to compliance.

Financial Institutions must find a way to balance the need for compliance with the fast-paced and ever-evolving nature of the industry.

AML compliance as a crucial tool in the fight against terrorist financing

When it comes to terrorist financing, AML compliance is essential for detecting and preventing the flow of funds to terrorist organizations. Financial institutions play a critical role in this fight as they are often the first line of defense in detecting and reporting suspicious activity.

AML compliance involves implementing a robust set of internal controls and procedures to detect and prevent money laundering and terrorist financing. This includes customer due diligence, transaction monitoring, and suspicious activity reporting. Financial institutions, including fintechs, neobanks, and other regulated entities are also required to maintain records of their AML compliance activities and to provide regular reports to regulatory authorities.

AML compliance also requires financial institutions to have a robust know your customer (KYC) process in place. This process involves collecting, verifying, and maintaining customer information to ensure that the customer is who they claim to be and to detect any suspicious activity.

Moreover, AML regulations have been continuously evolving and becoming more stringent. This is to ensure that financial institutions are keeping pace with the changes in the methods and techniques used by terrorist organizations to raise and move funds.

In conclusion, AML compliance is a crucial tool in the fight against terrorist financing, as it helps financial institutions detect and prevent the flow of funds to terrorist organizations. It's important for these financial institutions to stay up-to-date on the latest AML regulations and to continuously review and improve their internal controls and procedures to ensure they are effectively detecting and preventing terrorist financing.

In conclusion

It is important for fintechs and neobanks to have robust compliance solutions in place to detect and prevent terrorist financing. These solutions include real-time transaction monitoring, customer risk assessment, sanctions screening, KYC and KYB verification, which are necessary to comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

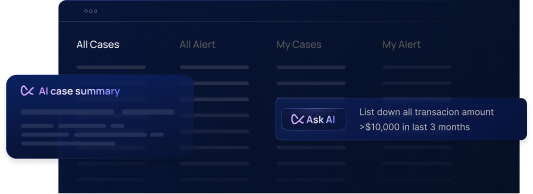

This is where Flagright comes in, our no-code centralized AML compliance and fraud protection platform is designed to address these challenges. It provides a more efficient and streamlined way for fintechs and neobanks to meet their compliance obligations, thus effectively detecting and preventing terrorist financing.

Our platform also offers fintech licensing and advisory services to help companies navigate the licensing process and stay compliant.

We understand the importance of AML compliance in preventing terrorist financing and we are committed to providing the solutions that fintechs and neobanks need to stay compliant.

If you want to learn more about our platform and how it can help your business, contact us here to schedule a free demo.

.svg)

.webp)