In the aftermath of the devastating terrorist attacks on September 11, 2001, the U.S. faced an urgent need to adapt and reinforce its security apparatus. While military and intelligence responses were immediately evident, there was another, less-visible frontline that required bolstering: the financial sector. Money, often discreetly moved across borders and between entities, had become one of the most potent weapons of terrorists. Stemming the flow of these funds, especially those used for malevolent purposes, emerged as a critical counter-terrorism strategy.

Enter the USA PATRIOT Act, an acronym for "Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001." This comprehensive legislation, signed into law mere weeks after the 9/11 attacks, sought to address various security vulnerabilities, with a significant portion dedicated to preventing money laundering and terrorist financing.

While many remember the PATRIOT Act for its intelligence and surveillance measures, its impact on the world of finance has been profound. Financial institutions, once primarily profit-driven entities, were now thrust into the forefront of national security efforts. The duty of ensuring that funds didn't end up in the wrong hands became a shared responsibility between these institutions and the government.

This article explores the many ways the USA PATRIOT Act reshaped the anti-money laundering (AML) landscape. From the stringent compliance measures imposed on banks to the innovative technologies developed in response, its impact remains significant two decades later. As we trace the evolution of AML efforts post-PATRIOT Act, we’ll examine the challenges, successes, and the ongoing balance between finance and security—highlighting how modern AML compliance solutions continue to adapt to emerging threats and technologies.

AML before the PATRIOT act

The concept of anti-money laundering (AML) did not originate with the PATRIOT Act; it had been on the radar of international law enforcement and financial communities for decades prior. However, the landscape before the enactment of this landmark legislation was considerably different, with its own set of challenges and limitations.

The genesis of AML

The roots of modern AML efforts can be traced back to the 1980s, a period that saw a surge in organized crime, especially drug trafficking. The vast amounts of money generated by these illicit activities needed a way to be integrated into the legal financial system without raising alarms. Money laundering emerged as the method of choice, with criminals deploying sophisticated tactics to disguise the illicit origins of their wealth.

Early legislative efforts

In response, the U.S. government initiated its AML journey with the passage of the bank secrecy act (BSA) of 1970. The BSA mandated financial institutions to maintain specific records of transactions and report certain kinds of activities, particularly those that might signify money laundering, like large cash deposits.

The money laundering control act of 1986 was another significant step. For the first time, it criminalized the act of money laundering and introduced civil and criminal penalties for institutions that failed to implement effective AML programs.

On the international front, the financial action task force (FATF) was established in 1989. This inter-governmental body aimed to set global standards for combating money laundering and, later, terrorist financing.

Limitations of early AML efforts

While these measures were groundbreaking at their inception, several challenges persisted:

- Fragmented oversight: Different financial institutions were governed by different regulatory bodies, leading to inconsistent AML measures and potential loopholes for money launderers.

- Evolving money laundering tactics: As authorities became more adept at detecting traditional money laundering methods, criminals evolved their tactics, exploiting emerging technologies and global financial pathways.

- Lack of comprehensive data sharing: While institutions were required to report suspicious activities, there wasn't a centralized or streamlined mechanism for agencies to share and analyze this data collectively.

- Global inconsistencies: While FATF tried to create a unified global response, not all countries adopted its recommendations uniformly. This patchwork implementation created international blind spots that launderers could exploit.

The changed paradigm post-9/11

The horrors of September 11, 2001, brought a stark realization: money laundering wasn't just a conduit for organized crime – it was a vital enabler of global terrorism. This shifted the AML discourse from being a purely financial concern to a matter of national, and even global, security. It was clear that piecemeal efforts would no longer suffice. A more holistic, rigorous, and collaborative approach was needed. The stage was set for the introduction of the USA PATRIOT Act, aimed at unifying and amplifying AML efforts like never before.

Key provisions of the USA PATRIOT act influencing AML

The USA PATRIOT Act, while extensive in its scope covering numerous areas related to counter-terrorism, contained specific provisions that dramatically reshaped the anti-money laundering (AML) landscape. These provisions intensified the requirements for financial institutions, aiming to plug the loopholes that money launderers and terrorist financiers might exploit.

- Title II – Enhanced surveillance procedures: This section of the Act dramatically expanded the ability of law enforcement and intelligence agencies to surveil and investigate financial transactions.

- Special measures: The Treasury could require financial institutions to undertake "special measures" against countries, financial institutions, or transactions deemed of primary money laundering concern.

- Expanded wiretap rules: Law enforcement could now wiretap any violation of federal criminal law, not just specifically designated offenses, giving them a wider net in monitoring potential money laundering or terrorist financing activities.

- Section 314 – Cooperative efforts: This provision had two vital components:

- Facilitating communication between institutions: It allowed financial institutions to share information with each other regarding possible terrorist activities or money laundering. This was pivotal, as previously, banks might have been hesitant to share such information due to competition or privacy concerns.

- Government and institution collaboration: It promoted information sharing between government agencies and financial institutions. This allowed the government to convey threats or concerns to the private sector, ensuring that financial institutions could be proactive in their surveillance.

- Rigorous financial controls

- Title III – International money laundering abatement and financial anti-terrorism act: This section directly addressed the AML deficiencies:

- Customer identification program (CIP): Financial institutions were mandated to implement reasonable procedures to identify and verify the identity of any person seeking to open an account.

- Enhanced due diligence (EDD): Institutions were required to employ EDD for high-risk accounts, especially correspondent accounts maintained by foreign banks.

- Suspicious activity reports (SARs): The Act expanded the criteria for when these reports should be filed. Banks, broker-dealers, and other entities were tasked with reporting suspicious activities that might indicate money laundering, terrorist financing, or other financial crimes.

- Prohibiting material support to terrorist organizations

- Title VIII – Strengthening the criminal laws against terrorism: While this title covered several aspects of counter-terrorism, from a financial perspective, it:

- Broadened the scope of criminal offenses: Giving money, tangible aid, or advice became offenses if they were found to support terrorist activities or organizations. Financial institutions, therefore, had to be extra cautious to ensure they weren't inadvertently facilitating such transactions.

- Oversight and penalties

- Increased oversight on specific financial transactions: This included a more rigorous focus on "correspondent accounts" for foreign banks, and "private banking accounts," which often involve high-net-worth individuals.

- Civil and criminal penalties: Financial institutions and their directors could face substantial fines or imprisonment if they willfully violated AML statutes, providing a stark deterrent against lax AML measures.

Modern AML landscape Post-PATRIOT act

The enactment of the USA PATRIOT Act marked a watershed moment in the history of anti-money laundering efforts. This seminal legislation not only fortified the defenses against illicit financial activities but also, indirectly, spurred innovation and global cooperation. Here's a look at the post-PATRIOT Act AML landscape:

- Technological advances

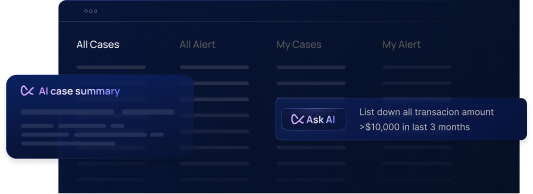

- Adoption of advanced monitoring tools: Financial institutions began leveraging technology to detect suspicious activities. This included pattern recognition software, artificial intelligence (AI), and machine learning algorithms that could pinpoint unusual transactions amidst millions that occur daily.

- Digital identification verification: As cyber threats grew, so did the means to counter them. Digital KYC (know your customer) platforms now use biometrics, facial recognition, and even blockchain to validate customer identities.

- Real-time transaction analysis: Traditional monitoring systems might have had a time-lag, but modern platforms offer real-time transaction scrutiny, ensuring rapid detection and response.

- Challenges for financial institutions

- Increased compliance costs: The rigorous demands of the PATRIOT Act meant institutions had to invest heavily in compliance infrastructure, training, and personnel.

- Navigating digital currencies: The rise of cryptocurrencies added another layer of complexity. These decentralized financial systems present both opportunities and challenges in tracking and reporting illicit activities.

- Maintaining customer trust: With heightened surveillance and data collection, financial institutions had to strike a balance between compliance and ensuring customer trust by safeguarding their privacy.

- Global Response and harmonization

- International AML standards: Post the PATRIOT Act, the financial action task force (FATF) revised its recommendations to incorporate counter-terrorist financing measures, leading to a globally synchronized response.

- Cross-border cooperation: Financial intelligence units (FIUs) across countries started working in tandem, sharing insights, and collaborating on investigations.

- Regional AML directives: Various regions introduced their own rigorous AML regulations, like the European Union's anti-money laundering directives (AMLD), which echoed many principles of the PATRIOT Act while adding localized nuances.

- Evolving regulatory environment

- Periodic review and amendments: Recognizing the dynamic nature of financial crimes, there have been periodic amendments to AML regulations, ensuring they remain relevant in the face of new threats.

- Specialized oversight bodies: Many countries established specialized agencies or oversight bodies dedicated solely to monitoring and ensuring AML compliance, indicating the gravity of the issue.

- Emphasis on non-financial businesses

- Extended scrutiny: Post-PATRIOT Act, the AML net was cast wider to include non-traditional financial entities, like casinos, real estate agents, and even precious metal dealers, acknowledging that money laundering could occur outside conventional banking channels.

Successes and critiques

The USA PATRIOT Act has undeniably reshaped the AML landscape. Two decades after its enactment, its successes are evident, but so are its critiques. Navigating this complex interplay gives us a clearer picture of the Act's real-world impact.

Successes

1. Robust financial monitoring

The Act played a critical role in elevating the standards of transaction monitoring, ensuring that financial institutions were more vigilant and proactive.

2. Enhanced international cooperation

The PATRIOT Act catalyzed a global movement towards harmonized AML practices, with institutions across borders now collaborating more than ever before.

3. Decline in high-profile money laundering cases

The rigorous regulations and monitoring have led to a significant decrease in large-scale money laundering operations, with many organized crime syndicates finding it harder to launder money covertly.

4. Boosting technological advancements

The Act indirectly spurred the growth of financial technology aimed at compliance, with innovations like AI-driven transaction monitoring and blockchain-based identity verification becoming industry standards.

5. Increased accountability

Financial institutions, understanding the legal repercussions, became more accountable, ensuring that they adhered to both the letter and spirit of the law.

Critiques

1. Civil liberties concerns

The Act, especially its surveillance provisions, faced criticism from civil rights groups who argued it intrudes into individuals' privacy, leading to potential misuse and overreach by intelligence agencies.

2. Strain on financial institutions

Many smaller banks and financial entities found the compliance costs burdensome, arguing that the expenditure on AML overshadowed their operational profits.

3. Effectiveness debate

Some critics questioned the overall efficacy of the Act, suggesting that while it caught smaller players, more sophisticated launderers could still navigate the system. The balance between false positives in transaction alerts and genuinely suspicious activities became a point of contention.

4. Overemphasis on penalties

The stringent penalties, while acting as a deterrent, also created an environment of fear. Some institutions might over-report, flooding agencies with insignificant alerts, merely to safeguard themselves from potential repercussions.

5. Global inconsistencies remain

Despite strides in international cooperation, discrepancies in AML practices across countries persist. Some regions or countries became known as "safe havens" due to lax regulations, undermining global efforts.

The Future of AML

Anti-money laundering efforts, shaped by the foundational elements of the USA PATRIOT Act, now stand at the cusp of a new era. As we move forward, several trends, challenges, and opportunities come into focus:

- Embracing technological advancements

- Artificial intelligence and machine learning: AI and ML will be central to the future of AML efforts. These technologies can parse through vast amounts of data, identify patterns, and provide predictive analytics to flag potential money laundering activities even before they occur.

- Blockchain and distributed ledger technology (DLT): Blockchain can provide transparent and immutable records. Especially in cross-border transactions, DLT can offer an irrefutable trail, making illicit financial activities harder to mask.

- Navigating the world of digital currencies

- Regulating cryptocurrencies: As digital currencies gain prominence, so does the need to regulate them. Bringing cryptocurrency exchanges and wallet providers under AML regulations will be pivotal.

- Central bank digital currencies (CBDCs): Several countries are experimenting with or launching their own digital currencies. These CBDCs will have built-in AML features, offering a balance between innovation and security.

- Holistic risk management

- Beyond transaction monitoring: AML efforts will likely move towards a more holistic risk management approach, encompassing not just transactional data but also contextual information, customer behavior, and external risk factors.

- Integrative solutions: Future AML platforms will offer integrated solutions, combining KYC, transaction monitoring, risk assessment, and reporting in a unified framework.

- Greater Global Cooperation

- Unified regulatory standards: While efforts like those of the financial action task force (FATF) have been commendable, the future will likely see an even more harmonized set of global AML regulations, ensuring that gaps between jurisdictions are minimized.

- Shared intelligence platforms: Countries and institutions will collaborate more intensively, sharing threat intelligence, best practices, and even resources in real-time.

- Enhancing privacy and data protection

- Balancing surveillance and rights: As AML tools become more invasive, there will be a parallel push to ensure that individual rights and privacy are upheld.

- Secure data management: Given the volume of financial data being processed, advancements in encryption and secure data storage will become indispensable.

- Evolving nature of financial crimes

- Adapting to new threats: As traditional money laundering pathways become challenging, criminals will innovate. AML strategies will need to be agile, continuously adapting to counter novel threats.

- Training and awareness: Human elements remain essential. Continuous training, awareness programs, and fostering a culture of compliance will be as crucial as technological tools.

Conclusion

In tracing the trajectory of AML practices from the enactment of the USA PATRIOT Act to present day, it's evident that the financial landscape has undergone monumental shifts. This legislation, along with subsequent technological and regulatory advancements, has fortressed global financial systems against illicit activities. Yet, as our previous article "Mitigating Risks in Remote Customer Onboarding” highlighted, the challenges are perennial, requiring constant vigilance and adaptability.

As we forge ahead, embracing technology and global collaboration will be paramount. For brokerages and trusts, the goal remains clear: safeguarding our financial systems while upholding the trust and rights of every individual. The journey is ongoing, and every stakeholder plays a crucial role in shaping the AML landscape of tomorrow.

.svg)

.webp)