Centralize fraud & AML operations on a single platform for transaction monitoring, AML screening, SAR filing, and more.

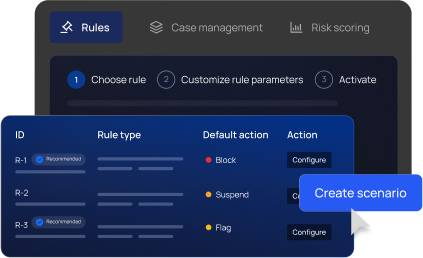

Launch new remittance rails in under 2 weeks with Flagright's no-code platform and CSV integrations.

Monitor transactions in real-time across bank transfers, wallets, and card payouts. Trusted by remittance providers globally.

Generate audit trails, logs, and reports in one click. Collaborate with the regulators without hassle.

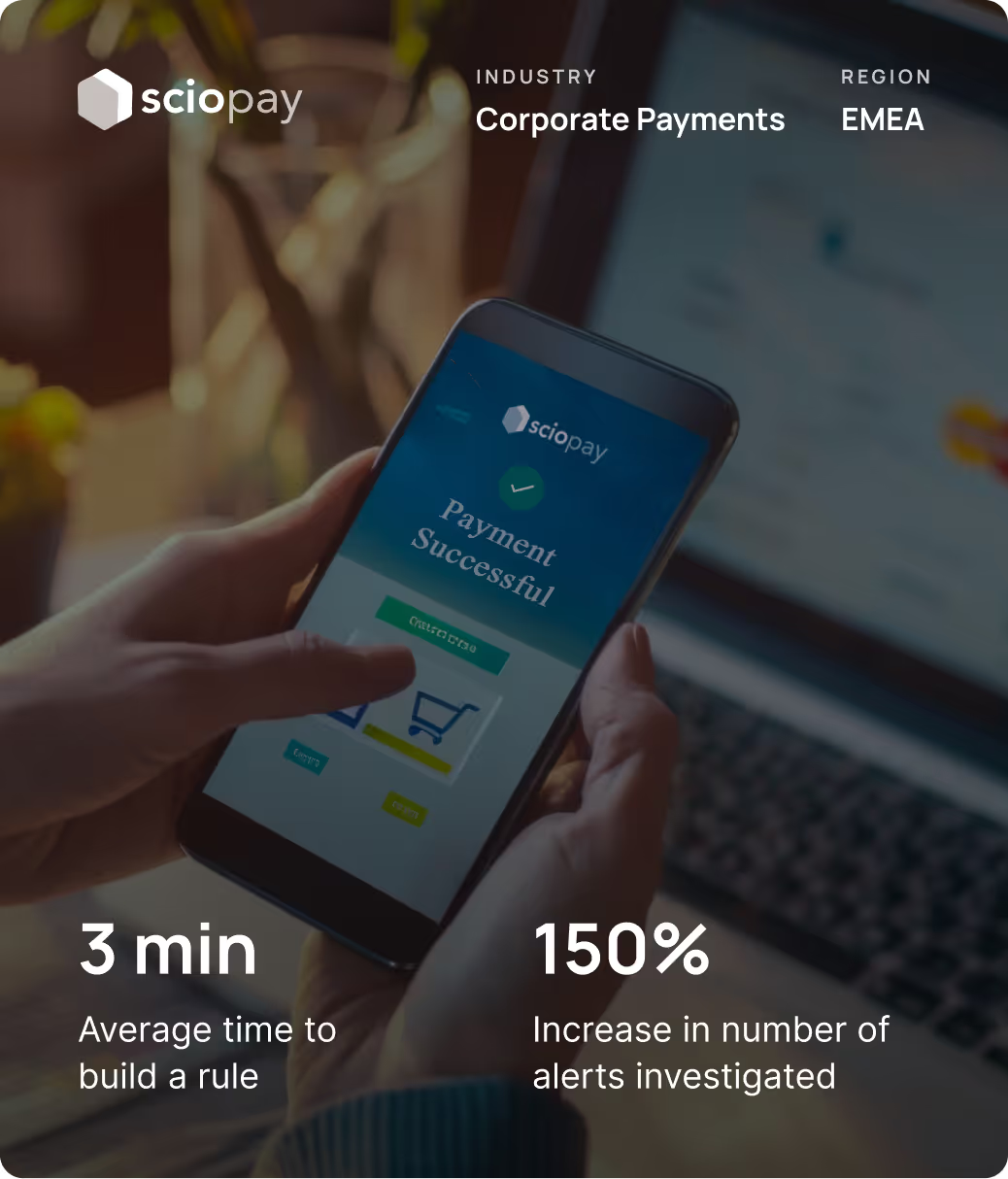

Achieved real-time transaction monitoring with a full platform go-live in just 7 days

Delivered consistently high system reliability and performance, ensuring uninterrupted compliance operations even as transaction volumes increased

Enabled more accurate risk detection and prioritisation, significantly reducing manual transaction reviews and analyst workload

Cross-border payments move fast. Regulators expect you to move faster. Flagright equips remittance providers with no-code workflows, rail-specific monitoring, and sub-second decisioning at scale.

Scale volume without scaling headcount. Flagright enables remittance providers to expand globally, open new rails, and serve more customers with confidence.

Get in touch

Sub-second API checks block fraud and laundering attempts before they settle.

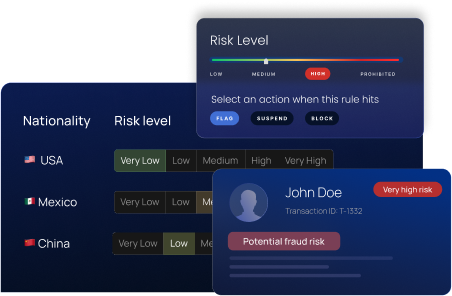

Configurable rail-specific thresholds detect structuring and repeat patterns unique to remittance flows.

Dynamic scoring frameworks apply differentiated controls based on rail, customer profile, and transaction behavior.

Adaptive thresholds trigger enhanced due diligence where ML/TF risk indicators are higher.

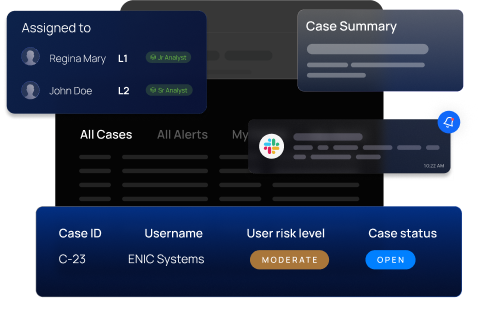

Centralized investigations consolidate alerts, escalations, and SARs across rails with full audit trails for regulator reviews.

AI-assisted narratives reduce manual review time by 75% while ensuring consistent, defensible case files.

Screen customers and counterparties against global or local sanctions, PEP, and adverse media watchlists.

AI-driven fuzzy matching reduces false positives by up to 93%, cutting noise without increasing exposure.

Automated triage handles first-level alerts, suppressing false positives instantly and escalating only those that require human review.

Cut investigation time in half with AI that crunches alert data, builds pivot-style breakdowns, and surfaces key risk patterns with explainable summaries analysts can defend.

“The best AML compliance solution we've used. Flagright has revolutionized how we approach compliance, setting a new benchmark for all vendors.”

“We’ve seen returns on investment from day one and what keeps us engaged is that Flagright always has something new in store.”

“Flagright’s ongoing engagement is unmatched. Their willingness to collaborate and understand the nuances of our AML needs is rare in the compliance space.”

4.67 months

Average ROI

98%

User adoption rate

95%

Client satisfaction

Gain real-time visibility into transactions, reduce false positives, and scale confidently across multiple rails without adding operational overhead.

Get a demo