AT A GLANCE

Risk scoring assigns numerical values to assess the potential threat a customer poses to your financial institution. By evaluating demographics, transaction patterns, and behavioral trends, organizations identify high-risk customers, prevent fraud, ensure AML compliance, and allocate resources effectively—all in real time.

What Is Risk Scoring?

Risk scoring calculates a numerical value indicating the severity of risk a customer or transaction poses to a financial institution. Without standardized risk scoring models, compliance teams cannot effectively communicate about resource deployment or reduce costs while minimizing business impact.

Risk scoring relies on two fundamental data categories:

Quantitative data assigns monetary values to risk components using numerical information to calculate risk event likelihood and potential financial exposure.

Qualitative data uses subjective assessment to evaluate risk probability against potential consequence severity.

Risk scoring is a core KYC (know your customer) pillar within AML (anti-money laundering) framework, assessing the risk level each customer presents at onboarding and continuously throughout the relationship.

Key Point: Risk scores are dynamic. Customer risk levels change based on behavior, requiring real-time monitoring and regular reassessment.

Why Do Financial Institutions Need Risk Scoring?

Financial institutions face unprecedented risk in today's digital banking environment. Without proper risk scoring, institutions remain vulnerable to money laundering, fraud, regulatory penalties, and reputational damage.

Risk scoring enables organizations to:

- Navigate regulatory complexity across multiple jurisdictions

- Optimize resource allocation on genuinely high-risk customers

- Prevent financial crime before it escalates

- Support data-driven strategic decisions

- Demonstrate regulatory due diligence

Fintechs, digital banks, and neobanks face acute challenges. As engines of financial innovation, they generate new risk scenarios that traditional models don't handle. For these institutions, embedding risk scoring into digital transformation is essential for viability.

What Types of Risks Require Scoring?

Financial institutions must effectively score and manage these critical risk types:

Fraud Risk - Identity theft, account takeover, and payment fraud

Anti-Money Laundering and Counter-Terrorist Financing (AML/CTF) - Criminals attempting to disguise illegally obtained funds or finance terrorism

Merchant Risk - Fraudulent merchant activities, chargebacks, or payment network rule violations

Regulatory Risk - Non-compliance with financial regulations resulting in fines or sanctions

Consumer Protection Risks - Potential harm through unfair practices or inadequate disclosures

Cybersecurity and Data Privacy - Data breaches, ransomware attacks, and unauthorized access

Credit and Operational Risk - Financial loss due to borrower default or process failures

Outsourcing Risk - Threats when third-party vendors handle critical functions

For fintechs and neobanks, risk scoring and assessment must be the starting point for risk and compliance programs. As new firms emerge, novel risks appear requiring proactive management. Risks can manifest themselves in a variety of ways.

How Does Data Volume Impact Risk Scoring?

Financial institutions manage massive volumes of personal and sensitive third-party data. This data abundance amplifies risk. The more data an institution holds, the larger the potential breach impact.

With ubiquitous online banking, data breaches are inevitable. Institutions must prepare accordingly.

When breaches, audits, or regulatory investigations occur, institutions survive only by demonstrating they took all reasonable protective measures.

The first step in minimizing data-related risks is gaining control of high-risk data. If an institution doesn't know what data it possesses, who accesses it, or where it's stored, it cannot regulate or protect itself.

Risks extend beyond cybersecurity. Social media marketing poses brand threats, customer profiling creates privacy vulnerabilities, cloud storage introduces third-party risk, and API integrations expand attack surfaces.

Risk assessment must be founded on understanding and quantifying risk through complete data inventories and automatic classification of risk levels, business value, and compliance obligations.

What Is a Risk Scoring Model?

A risk scoring model is a structured framework using specific criteria and algorithms to calculate risk scores systematically, ensuring consistency, objectivity, and defensibility across the entire customer base.

Effective models incorporate:

Defined Risk Factors - Data points correlating with risk levels (transaction patterns, geographic locations, business types)

Weighting Mechanisms - Mathematical formulas assigning relative importance based on predictive power

Scoring Algorithms - Computational methods combining weighted factors into numerical scores

Threshold Definitions - Clear boundaries determining low, medium, or high risk

Validation Processes - Regular testing ensuring accurate predictions without excessive false positives

Models range from simple rule-based systems to sophisticated machine learning algorithms. The appropriate complexity depends on institution size, customer diversity, transaction volume, and risk appetite.

Modern models must be dynamic. Static models assigning scores at onboarding and never updating fail to capture changing customer behavior.

What Is Risk Scoring Methodology?

Risk scoring methodology refers to the systematic approach organizations follow to identify, assess, calculate, and act upon risk scores. This methodology provides the procedural framework ensuring risk scoring happens consistently and effectively.

A comprehensive risk scoring methodology includes:

Risk Identification Protocols - Procedures for recognizing potential risk indicators across all data sources

Assessment Standards - Criteria for evaluating risks using quantitative metrics and qualitative judgment

Calculation Methods - Step-by-step processes for computing scores, including data normalization and factor weighting

Review Cycles - Defined frequencies for reassessing scores (continuous monitoring, quarterly reviews, event-triggered assessments)

Escalation Procedures - Clear pathways routing high-risk scores to appropriate personnel

Documentation Requirements - Standards for recording assessments and supporting evidence for regulatory examination

Organizations must regularly update methodologies to reflect evolving regulatory requirements, emerging fraud typologies, lessons learned from investigations, and new data sources.

Financial institutions that fail to update risk thresholds set themselves up for compliance failures. Risk assessments function as reality checks—organizations must be transparent about the severity and likelihood of risks.

How to Do Risk Scoring: Step-by-Step Process

Step 1: Customer Vetting and Screening

Customer vetting forms the foundation of risk scoring by helping institutions verify that each customer's transactions remain legal.

Screen every customer against:

- Sanctions lists (OFAC, UN, EU, country-specific)

- Politically exposed persons (PEP) databases

- Adverse media sources

- Law enforcement databases

- Internal watch lists

Regulations mandate ongoing screening—not just at onboarding. A customer passing initial screening might later appear on sanctions lists.

Practical tip: Automated screening systems should run continuously or at minimum daily.

Step 2: Demographic Analysis

Demographic checks evaluate variables correlating with money laundering and fraud risk patterns.

Analyze:

- Nationality and country of residence (higher-risk jurisdictions per FATF)

- Occupation (cash-intensive businesses, politically exposed positions)

- Date of birth (age-related fraud patterns)

- Length of relationship with institution

- Residential and mailing addresses

- Credit score and financial history

Each demographic factor receives risk weight based on empirical correlation with financial crime.

Practical tip: Don't treat all high-risk factors equally. A customer from a high-risk jurisdiction with legitimate documentation poses a different risk than someone providing minimal information.

Step 3: Transaction Pattern Analysis

Institutions must examine customers' income sources and verify that transaction patterns align with stated occupation, business type, or location.

Evaluate:

- Transaction frequency (sudden increases may indicate laundering)

- Transaction amounts (structuring patterns below reporting thresholds)

- Geographic distribution (unexpected international transfers)

- Counterparty analysis (transfers to high-risk jurisdictions)

- Cash usage patterns (excessive deposits or withdrawals)

- Product usage (appropriate account use)

This determines whether transactions make logical sense given the customer's risk profile.

Practical tip: Establish baseline behavior during the first 90 days, then flag deviations for review.

Step 4: Behavioral Trend Monitoring

Institutions must continuously review operational trends and red flags beyond transactions.

Monitor:

- Fraud alerts and reports

- Suspicious activity reports (SARs)

- Suspicious transaction reports (STRs)

- Customer service complaints

- Failed authentication attempts

- Unusual account access patterns

- Rapid changes to account details

Behavioral indicators often precede transaction-based red flags.

Practical tip: Implement behavioral analytics weighting multiple minor red flags together. Three low-level alerts combined could indicate coordinated fraud.

Step 5: Continuous Score Recalculation

Customer risk scores must update dynamically as new information becomes available.

Implement:

- Real-time transaction scoring evaluating each payment against risk profiles

- Event-triggered rescoring for significant changes

- Scheduled comprehensive reviews (monthly, quarterly, or annually)

- Machine learning models identifying emerging patterns

Because customer risk can shift rapidly, periodic manual reviews create dangerous coverage gaps.

What Are Common Risk Scoring Mistakes to Avoid?

Failing to Update Risk Models - Outdated risk factors create blind spots

Setting Unrealistic Thresholds - Being too conservative or too permissive both create problems

Ignoring False Positive Rates - Excessive false positives overwhelm investigation teams

Treating Risk Scores as Static - Effective risk scoring is continuous, not one-time

Over-Relying on Automation - Human judgment remains essential for complex cases

Inadequate Documentation - Poor documentation creates compliance risk

How Does Real-Time Transaction Monitoring Support Risk Scoring?

Real-time transaction monitoring represents the operational implementation of risk scoring models. While risk scores assess overall customer risk levels, transaction monitoring evaluates individual payments against those profiles to detect suspicious activity as it happens.

Real-time monitoring systems:

Evaluate every transaction instantly against the customer's risk score, behavioral patterns, and risk rules before approving or flagging for review.

Adjust risk assessments dynamically as new transactions provide additional behavior data.

Enable immediate intervention when high-risk customers attempt suspicious transactions, preventing financial crime rather than just detecting it.

Reduce financial exposure by stopping potentially fraudulent transactions before funds leave.

Generate data for risk score refinement by providing continuous feedback about which characteristics correlate with actual fraud.

The integration between risk scoring and real-time monitoring creates a feedback loop: risk scores inform transaction monitoring rules, while monitoring results validate and improve risk scoring models.

Organizations without real-time capabilities face systematic disadvantages. By the time they identify suspicious patterns through batch processing, funds have moved and prevention opportunities have passed.

What Role Does AML Compliance Play in Risk Scoring?

AML compliance and risk scoring are inseparable. Risk scoring isn't merely an AML best practice—it's a regulatory requirement. Financial institutions must conduct risk assessments of customers, products, services, and geographic exposure to comply with AML regulations across virtually all jurisdictions.

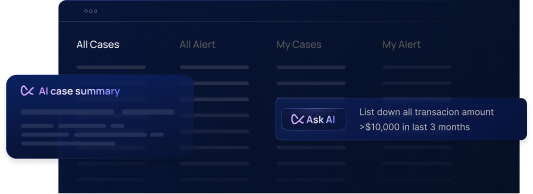

Using a robust AML compliance solution streamlines risk scoring and ensures risks are identified and addressed effectively. These solutions provide:

Integrated data collection from multiple sources into unified customer profiles

Automated risk calculations applying sophisticated algorithms consistently across the customer base

Audit trails documenting every risk assessment decision for regulatory examination

Configurable rules allowing institutions to customize risk factors and weights

Regulatory reporting generating suspicious activity reports directly from risk assessment data

Regulators don't just want to see risk scores—they want to understand the methodology, validate effectiveness, and confirm high-risk customers receive appropriate enhanced due diligence.

Manual or spreadsheet-based risk scoring cannot scale to meet modern regulatory expectations. The volume of customers, transactions, and data points requires purpose-built systems maintaining consistency and transparency.

How Do You Build an Effective Customer Risk Profiling System?

Customer risk profiling extends beyond simple risk scoring to create comprehensive risk portraits considering the full context of each relationship.

Effective systems incorporate:

Holistic Data Integration - Combining information from multiple sources into complete customer profiles

Segmentation Strategies - Grouping customers with similar characteristics for efficient monitoring

Risk Indicators Specific to Customer Type - Different factors matter for individuals versus businesses

Relationship Mapping - Understanding connections between customers, beneficial owners, and transaction counterparties

Industry-Specific Risk Factors - Cash-intensive businesses and PEPs require specialized assessment

Enhanced Due Diligence Triggers - Clear criteria automatically escalating customers when thresholds are exceeded

Customer risk profiling in banks differs from profiling in fintechs. Traditional banks have longer relationships and more comprehensive financial data, while digital-first institutions build profiles with limited initial information but more detailed digital behavioral data.

What Are Risk Scoring Algorithms and How Do They Work?

Risk scoring algorithms are computational engines transforming raw customer data into actionable risk scores.

Rule-Based Algorithms apply predetermined criteria and weights. Example: High-risk jurisdiction = +30 points, PEP status = +50 points. Total points determine risk tier.

Advantages: Transparent, explainable, easy to audit

Limitations: Cannot adapt to new patterns

Statistical Models use regression analysis to weight factors based on historical correlation with actual fraud cases.

Advantages: Data-driven factor weights, quantifiable accuracy

Limitations: Require substantial historical data

Machine Learning Algorithms employ techniques like random forests or neural networks to identify complex patterns across hundreds of variables.

Advantages: Detect subtle patterns, continuously improve

Limitations: Less explainable, risk of bias

Hybrid Approaches combine rule-based systems for transparency with machine learning for pattern detection.

The most effective systems use hybrid algorithms applying mandatory rules for regulatory compliance while using machine learning to identify emerging risk patterns.

How Often Should Risk Scores Be Updated?

Continuous Monitoring (Real-Time) - Every transaction triggers real-time risk evaluation. Prevents suspicious transactions before completion.

Event-Triggered Updates - Major deposits, address changes, negative news alerts, sanctions list additions trigger immediate reassessments.

Scheduled Comprehensive Reviews - High-risk customers: monthly or quarterly; Medium-risk: quarterly or semi-annually; Low-risk: annually.

Best practice: Implement all three mechanisms. Real-time monitoring catches immediate threats, event triggers capture significant changes, and scheduled reviews ensure no customer slips through.

Financial institutions updating scores only annually create 12-month windows where customer behavior might deteriorate unnoticed.

What Makes a Risk Scoring System Effective?

Accuracy and Precision - Correctly identifies high-risk customers while minimizing false positives

Comprehensive Coverage - Considers all relevant risk factors—demographic, transactional, behavioral, contextual

Transparency - Clear audit trails documenting all inputs and decisions

Adaptability - Evolves with changing risk landscapes and regulatory changes

Scalability - Consistent performance whether processing hundreds or millions of customers

Integration - Seamless connections with other compliance tools

Regulatory Alignment - Methodologies meet or exceed regulatory requirements

Technology alone doesn't create effective risk scoring. Systems must be supported by clear policies, trained personnel, governance oversight, and continuous validation.

Practical Tips for Implementing Risk Scoring

Start with Clear Objectives - Define what you're achieving: compliance, fraud prevention, or resource optimization.

Involve Multiple Stakeholders - Ensure all perspectives inform model design.

Begin Simply - Implement basic rule-based scoring first, then add sophistication gradually.

Validate Performance Regularly - Track detection rate, false positive rate, and investigator productivity.

Document Everything - Record methodology, factor weights, threshold decisions, and performance results.

Test Against Historical Data - Verify new models would have detected known fraud incidents.

Plan for Model Drift - Establish processes for detecting and correcting drift before creating blind spots.

Invest in Quality Data - Implement data cleansing and normalization processes.

Balance Automation with Judgment - Automate routine assessments; ensure complex cases receive expert review.

Communicate Effectively - Teams need to know what "high risk" means operationally.

Frequently Asked Questions

What is the difference between risk scoring and risk rating?

Risk scoring assigns numerical values based on mathematical calculations of multiple risk factors. Risk rating translates those scores into categorical classifications (low, medium, high) that drive operational decisions. The score provides granularity; the rating provides actionable tiers.

How do you calculate a customer risk score?

Calculate by: (1) Identifying relevant risk factors, (2) Assigning numerical values to each factor, (3) Weighting factors according to predictive importance, (4) Aggregating weighted values, and (5) Normalizing to a standard scale. The specific method depends on your chosen model.

Can risk scoring prevent money laundering?

Risk scoring doesn't directly prevent money laundering but enables prevention by identifying high-risk customers requiring enhanced monitoring before they can successfully launder funds. Combined with real-time transaction monitoring, risk scoring catches suspicious patterns early enough to block illegal transactions.

What is customer risk profiling in banks?

Customer risk profiling creates comprehensive risk assessments by analyzing demographics, transaction patterns, products used, geographic exposure, and behavioral characteristics. This profile determines the due diligence level and monitoring intensity applied throughout the relationship.

How does AI improve risk scoring?

AI improves risk scoring by detecting complex patterns across hundreds of variables impossible for humans to identify manually, adapting automatically to emerging fraud typologies, processing massive transaction volumes in real time, and continuously learning from new data to improve accuracy while reducing false positives.

What are the main components of an AML risk assessment?

Main components include: customer risk factors (demographics, occupation, source of funds), product and service risks (account types, transaction capabilities), geographic risks (customer locations, transaction destinations), and distribution channel risks (online, branch, mobile). All combine to create overall institutional risk profiles.

How do you reduce false positives in risk scoring?

Reduce false positives by: refining risk factor weights based on actual case outcomes, implementing machine learning models identifying subtle differences between legitimate and suspicious activity, using behavioral analytics to understand normal customer patterns, regularly tuning alert thresholds, and incorporating negative indicators.

What is the role of transaction monitoring in risk scoring?

Transaction monitoring operationalizes risk scoring by evaluating individual transactions against customer risk profiles. High-risk customers face more stringent transaction rules and lower alert thresholds. Transaction monitoring also provides feedback data improving risk scoring model accuracy over time.

How often should customer risk assessments be updated?

Update based on risk tier: high-risk customers monthly or quarterly, medium-risk quarterly or semi-annually, and low-risk annually. Additionally, trigger immediate reassessments when significant events occur (large transactions, address changes, negative news, sanctions list updates) regardless of scheduled timing.

What regulations require risk scoring?

Multiple regulations require risk scoring including: the Bank Secrecy Act (BSA) in the United States, EU Anti-Money Laundering Directives, FATF Recommendations requiring risk-based approaches, the USA PATRIOT Act, FinCEN regulations, and jurisdiction-specific AML laws worldwide. Most financial regulators globally mandate risk-based customer due diligence.

Key Takeaways

Risk scores are dynamic, not static - Customer risk levels change based on behavior, requiring continuous monitoring

Combine quantitative and qualitative data - Both numerical data and subjective assessments contribute to accurate evaluation

Update models regularly - Fraud patterns evolve constantly, requiring ongoing model refinement

Balance automation with expertise - Automated systems provide scale; human judgment handles complex cases

Document everything - Regulatory examiners expect comprehensive methodology and performance records

Integrate with transaction monitoring - Risk scoring informs real-time decisions, creating unified financial crime prevention

Focus on data quality - Risk scoring accuracy depends entirely on input data quality and timeliness

Conclusion

Risk scoring has evolved from periodic compliance into real-time operational necessity. Institutions that thrive treat risk scoring as a dynamic capability protecting the organization while enabling legitimate customer activity.

Effective risk scoring requires the right combination of technology, data, methodology, and expertise. Purpose-built platforms monitoring risk levels and customer behavior in real time provide the foundation for sustainable compliance and fraud prevention.

The future lies in systems combining regulatory rigor with operational intelligence—platforms that calculate risk scores and deliver actionable insights with minimal effort, enabling teams to focus on genuine threats.

Risk scoring quality directly impacts your ability to prevent financial crime, satisfy regulators, optimize resources, and provide seamless customer experiences. Inadequate risk scoring creates exposure no organization can afford. Reach out to us to discuss how to reduce risk and improve decision accuracy.

.svg)