Businesses today are seeing a big shift in how they handle money and payments. Fintech and even crypto banking have changed the way businesses use financial services, making things faster and more efficient, especially with the growth of crypto and stablecoin activity. These new digital tools give businesses more options and freedom to manage their finances.

So, what is Banking-as-a-Service (BaaS), and why does it matter? Let’s take a closer look.

What is Banking as a Service (BaaS)?

Banking-as-a-Service (BaaS) is a new way for companies to use financial services that are customized to their needs. BaaS allows companies to use banking services through APIs (a type of software tool) instead of needing to build their own bank. This makes it easier and faster for businesses to offer banking services like loans, payments, and more.

The need for BaaS

As fintech companies became known for lower friction and an enhanced customer experience, financial institutions and companies from other industries began exploring how to offer financial services virtually. Regional banks and credit unions found it hard to keep their main depositors and offer similar services because of product silos, infrastructure that was built decades ago, and traditional business models. Collaboration with fintechs became a viable and tested option for leveraging the most innovative tech solutions that consumers were using, as well as a path to remaining relevant within the industry.

Businesses had a hard time getting a financial service off the ground because there were so many expensive obstacles in their way. Such a business would necessitate a Money Service Business (MSB) license and the application for state-by-state monetary transmission licenses (MTLs) in the United States, for example (which may take up to two years); the startup company would then need to find a partner bank. This was a separate process that required applying directly to a bank, which may require significant amounts of money to be raised before beginning their 12-18 month evaluation process. This method also required the startup to develop (or contract to a third party) technology for the user interface and onboarding, regulatory and risk controls (such as Know-Your-Customer), and periodic agency audits or government reporting obligations. With high upfront costs, investment capital required, and a timeframe of over 1–2 years just to test the market, organizations were eager for a faster, lower-cost solution.

How does BaaS work?

Banking-as-a-Service has become the most innovative way for fintech to quickly bring a customer-focused bank platform to market through digital means. Through APIs, BaaS providers have been able to offer a banking infrastructure that can be built and put into use in a matter of months, without requiring financial licenses or large rounds of funding for most uses. APIs can be thought of as Lego blocks that fit together to construct a banking core framework—a user can be established and transactions can be completed through a sequence of API calls. Then, to set up deposit accounts, debit or credit cards, and loans, more customization is added.

Here’s a detailed breakdown of a 3-layered, API-based Banking-as-a-Service stack:

- The first layer represents the traditional financial institution (bank) that partners with the BaaS provider — also known as the “Infrastructure-as-a-Service (IaaS) layer.”

- The second layer represents the “Bank-as-a-Service layer” that maps out banking services customized as an ecosystem for fintech companies to deliver products to end users. This part of the stack sends data back and forth between the bank and fintech, through the BaaS provider as an intermediary.

- The third layer is the fintech company that interfaces with the end user — receiving data from customers on transaction requests that it sends to the BaaS layer. The BaaS provider also sends data from the bank to the fintech as responses to transaction requests.

As the Banking-as-a-Service sector evolves to incorporate a cloud-based stack, larger tech companies with banking licenses would be able to remove the layers. A potential example would be Amazon Web Services obtaining financial licensing and becoming a prominent IaaS provider that also provides server hardware.

Additionally, banks in this model can develop Banking-as-a-Platform (BaaP) and deliver “fintech SaaS," allowing companies to directly plug into their core infrastructure for banking products on-demand—without the need for a BaaS provider to be in the middle. The result would be a virtual marketplace for purchasing and launching bank products.

What factors are influencing BaaS?

Even though fintech is changing the way financial services are provided, there are a few big things that have led to the rise of BaaS.

- Banks are trying to match the speed of fintech companies. Additionally, banks are collaborating with fintech companies to develop new financial services.

- Startups and SMEs are beginning to take advantage of more convenient and effective business banking.

- Banking business architecture is evolving into a much more sophisticated system that incorporates newer technology and techniques.

- Banking regulations have evolved, which has aided in the healthy expansion of the industry.

- The digital transformation and mobile-first mindset that has blossomed in recent years have had a tremendous impact on BaaS.

What are the benefits of BaaS?

Banking-as-a-Service is very helpful to small and medium-sized enterprises (SMEs) in many ways. It helps them improve their value proposition, gain customer loyalty, and remove sales barriers.

For instance, a key part of running a successful subscription-based business is making sure payments go through without issues. Sometimes, payments fail because of things like expired credit cards or insufficient funds. This can lead to what's called "involuntary churn," where customers are lost without actively canceling their service.

Fintech companies are stepping in with AI-powered solutions to tackle this issue. Smart AI-based systems such as Flycode can automatically identify failed payments, retry them at the best times, and notify customers through email or text. This can help businesses reduce churn and maintain a steady cash flow, ensuring payments are processed smoothly without losing customers.

Some additional benefits of using BaaS include:

- Providing more flexible payment solutions through trusted payment processors, allowing fintech companies to boost sales by making their offerings more accessible.

- Eliminating international barriers by making it easier and less expensive to accept payments from abroad.

- Potentially lower operational costs, resulting in increased cash flow.

- There is a lot more room for fintech companies to customize their financial products to the market and empower customers by allowing them to manage their payments and subscriptions through a more digitalized platform that also supports remittances.

- Digital BaaS platforms are also massive data centers. This can provide crucial insights into customer patterns and help fintech companies better personalize their financial products and offerings.

- In a fast-growing global market, BaaS solutions are always developing and evolving, allowing fintechs to position themselves as an invaluable asset to their customers.

Banking as a Service vs open banking

People often confuse the BaaS idea with open banking because both require APIs for banks and fintech companies to interact with each other. Meanwhile, both models serve quite different purposes.

Banking as a Service: Companies incorporate full banking services into their products.

Open Banking: Businesses only use data to create their product offerings.

Future trends for BaaS

Some future Banking-as-a-Service trends include:

- Bank system modernization and digitization to support BaaS.

- Increase in fintech companies and financial services apps.

- Impressive adoption rate of BaaS in many industries.

- More banks and BaaS platform providers with non-bank BaaS connections.

- Additional embedded financial products and services.

The use of BaaS is gaining traction. A survey done by Finastra in March 2022 says that "banking as a service" will be a $7 trillion business by 2030.

Also, according to Future Market Insights, the worldwide BaaS platform market (one layer of the BaaS stack) is increasing at a CAGR of 15.7% and is predicted to reach $12.2 billion by 2031.

In conclusion

BaaS is still a new concept for many banks and financial institutions. But, as the benefits become more clear, it's likely that we'll see a lot more adoption of this model in the years to come.

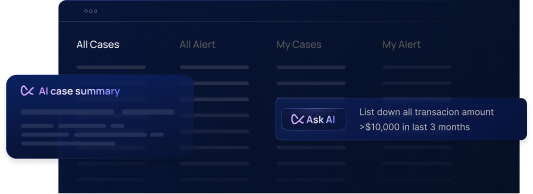

If you're a fintech or startup interested in onboarding with a BaaS, Flagright’s Launchpad offers a great solution that can help your business get up and running quickly and easily. We help fintechs get the licenses they need to open businesses in the UK, Singapore, and other global markets. Our team of experts can help you make custom AML policies and get through the complicated licensing process, making sure that you meet all the regulatory requirements in these growing markets.

Contact us to get started

.svg)

.webp)