In the complex world of finance, Ponzi schemes are an unfortunate reality that can lead to significant losses for unwary investors. Named after Charles Ponzi, who notoriously used this fraudulent technique in the 1920s, Ponzi schemes are a type of investment fraud that promise high returns with minimal risk.

In essence, a Ponzi scheme is an investment scam that involves the payment of purported returns to existing investors using funds contributed by new investors. It is a deceitful practice that thrives on a continuous influx of new participants to sustain operations, often disguising transactions through intermediaries or payment processors to appear legitimate. This illusion eventually unravels when the flow of new investments slows, leading to the scheme’s inevitable collapse and the exposure of its fraudulent structure.

It is of paramount importance for anyone involved in financial transactions, whether an individual or a financial institution, to understand the mechanics of Ponzi schemes. This understanding not only aids in recognizing such fraudulent schemes but also plays a vital role in their prevention. With proper awareness and vigilance, it becomes easier to safeguard one's financial interests and contribute to an ethical and transparent financial environment.

In this article, we delve deep into the mechanics of Ponzi schemes, shedding light on how they work, their lifecycle, and their impact. We will also look at the red flags that may indicate the presence of a Ponzi scheme and the role of financial institutions and regulatory bodies in detecting and preventing them. Furthermore, we'll explore how fintech and anti-money laundering strategies can be employed to combat such fraudulent activities.

By gaining a deeper understanding of Ponzi schemes, we can arm ourselves with the knowledge necessary to spot these schemes and prevent falling victim to them.

The concept of ponzi schemes

A Ponzi scheme is a fraudulent investing scam that guarantees high rates of return with little risk to investors. The scheme leads investors to believe that profits are coming from legitimate business activity, while in reality, it's all an elaborate facade. The returns are not generated from any successful enterprise or investment strategy but rather from the funds provided by new investors.

At its core, a Ponzi scheme operates on a simple principle: "Robbing Peter to pay Paul." Initial returns are paid out to investors from the funds of new participants, rather than from profits earned by the operator of the scheme. These early high returns serve to convince more individuals to invest their money, thereby supplying the fraudster with a constant influx of cash.

The central characteristic of a Ponzi scheme is the reliance on attracting new investors to pay the returns promised to existing ones. New capital infusion is crucial to keep the scheme afloat. As long as new investors keep entering the scheme and existing investors do not demand full repayment of their investments, the operators of the scheme can keep the illusion of profitability alive.

The false promise of high returns with minimal risk is incredibly enticing, but it is essential to remember that in most legitimate investments, higher returns are accompanied by higher risk. Ponzi schemes exploit the natural human tendency towards greed, often dazzling investors with the prospect of 'too good to be true' returns. This becomes the bait that lures unsuspecting investors into the trap.

In contrast to legitimate investment strategies, a Ponzi scheme does not involve any real investment. There is no product or service at the heart of the scheme, no genuine revenue generation. Instead, the operator simply shuffles money from one investor to another and skims off a portion for themselves.

Understanding the concept of Ponzi schemes is the first step in protecting oneself from falling prey to them. It is a reminder that caution and diligence should always be applied in the world of investments, especially when an opportunity appears overly promising.

The lifecycle of a ponzi scheme

Understanding the lifecycle of a Ponzi scheme is crucial in recognizing its operations and, therefore, protecting oneself from falling into its trap. The lifecycle typically unfolds in four key phases: the initiation phase, expansion phase, saturation phase, and collapse phase.

- Initiation phase: This is where it all begins. The scheme operator launches the Ponzi scheme and attracts the initial group of investors with the promise of high returns and minimal risk. The operator often relies on their personal network or targeted marketing to draw in these early investors. The success of this phase lies in convincing this initial group, as they are likely to spread the word and bring in more investors.

- Expansion phase: Once the first investors see their promised returns – paid from their own invested funds or the funds of other new investors – they're likely to reinvest and spread the word to others. This word-of-mouth advertising fuels the recruitment of new investors, and the scheme begins to expand. During this phase, the scheme may seem incredibly successful to outside observers. More and more people invest, lured by the seemingly high returns and positive feedback from early investors.

- Saturation phase: However, as with any scheme that promises a high return with low risk, there's a limit to the number of new investors. Eventually, the scheme reaches a saturation point where the influx of new investors slows down. It becomes increasingly difficult to find more people to invest in the scheme, and this phase signals the beginning of the end for the Ponzi scheme.

- Collapse phase: When new investment slows, the operator begins to struggle with meeting the promised returns and the withdrawal requests of existing investors. Since the scheme relies on the continuous inflow of new funds, this slowdown becomes its downfall. The scheme operator may attempt to disappear with the money or convince investors to "roll over" their investments to buy some time. However, the collapse of the scheme is inevitable. It's not a matter of if, but when.

The lifecycle of a Ponzi scheme, from initiation to collapse, is a compelling tale of deceit and inevitable failure. The understanding of this lifecycle is essential to identify such schemes and to remain cautious of investment opportunities offering unrealistically high returns with low risk.

Identifying ponzi schemes

While Ponzi schemes can be convincingly packaged, there are several red flags that may indicate the presence of such a scheme. Awareness of these warning signs can be instrumental in identifying and avoiding potential scams.

- Promised high returns with little or no risk: This is one of the most telltale signs of a Ponzi scheme. Any investment comes with some degree of risk, and it's generally true that higher potential returns come with higher risk. An investment opportunity promising consistent, high returns with little or no risk should be treated with extreme caution.

- Overly consistent returns: Investments in markets fluctuate over time. Even high-performing investments will experience ups and downs. However, Ponzi scheme operators will often showcase overly consistent returns, irrespective of market conditions, to entice investors.

- Unregistered investments: Ponzi schemes typically involve investments that are not registered with regulatory authorities. Lack of registration makes it easier for fraudsters to avoid scrutiny. Therefore, always verify whether an investment is registered with the appropriate regulatory body.

- Complex or secretive strategies: Ponzi schemes often involve complex strategies that are difficult for most people to understand, or they are shrouded in secrecy. A legitimate investment should always be explainable and transparent. If an investment strategy cannot be clearly explained or is shrouded in secrecy, it's a warning sign.

- Issues with paperwork: Errors, inconsistencies, or issues in investment paperwork can be another warning sign of a Ponzi scheme. Investors should always pay close attention to their investment documents and confirm their accuracy.

- Difficulty receiving payments: If an investor is struggling to receive payments or is encouraged to "roll over" investments, it could be an indication of a Ponzi scheme. Ponzi schemes rely on the continuous recruitment of new investors, so they may discourage withdrawals, delay remittances, or make it difficult for investors to access their money.

- Pressure to recruit: If there's a significant emphasis on attracting new investors and incentives are offered for doing so, it could be a sign of a Ponzi scheme. This pressure to recruit is often a tactic used to keep the scheme afloat.

Regulatory bodies play a vital role in identifying and preventing Ponzi schemes. They oversee and enforce regulations designed to protect investors and maintain the integrity of the markets. As an investor, it's important to report any suspected fraudulent activity to these authorities.

The recognition and avoidance of Ponzi schemes require vigilance and understanding. It's crucial to thoroughly evaluate investment opportunities, ask questions, and verify information before committing any funds. Remember, if something sounds too good to be true, it probably is.

Impact of ponzi schemes

The impact of Ponzi schemes extends far beyond individual victims, affecting society at various levels and posing a significant threat to the stability and integrity of financial markets. Let's delve into some of these impacts:

- Economic implications for individuals: The immediate and most palpable impact of a Ponzi scheme is felt by the individual investors who lose their money. These schemes often target ordinary people, who may lose their life savings, retirement funds, or other significant financial resources. The economic hardship experienced by these individuals can be devastating and, in many cases, irreversible.

- Loss of trust in financial markets: Ponzi schemes erode trust in financial markets. When people lose their savings due to such fraudulent schemes, they may become wary of investing again, even in legitimate ventures. This lack of trust can stifle investment and slow down economic growth.

- Societal impact: The societal impact of Ponzi schemes is substantial. These fraudulent schemes can lead to significant social harm, including increased rates of suicide, depression, and other mental health issues among victims. Moreover, there can be a detrimental impact on families and communities, leading to broken relationships and community distrust.

- Legal consequences for the operators: Operators of Ponzi schemes face severe legal consequences when their fraudulent activities are discovered. These can include criminal charges, substantial fines, and lengthy prison sentences.

- Regulatory response and financial burden: When a Ponzi scheme collapses, regulatory bodies step in to investigate and try to recover lost funds. However, this process is lengthy, expensive, and often recovers only a fraction of the lost money. The financial burden of these investigations is typically borne by the taxpayers.

- Impact on the economy: On a broader scale, Ponzi schemes can destabilize financial systems, especially if they are large enough. When they collapse, they can cause panic in the markets, potentially leading to significant financial crises.

Despite these severe consequences, Ponzi schemes continue to surface around the globe, a testament to the allure of 'easy money.' However, the long-term damage caused by these schemes, both to individuals and society as a whole, far outweighs any short-term gains for a select few. It's essential to stay educated about these schemes and remain vigilant when considering investment opportunities to minimize their devastating impact.

Role of financial institutions in detecting and preventing ponzi schemes

Financial institutions play a pivotal role in detecting and preventing Ponzi schemes. Their unique position within the financial ecosystem enables them to implement safeguards that protect investors and maintain market integrity.

- Transaction monitoring: Financial institutions can closely monitor transactions to detect unusual or suspicious activities, which may indicate a Ponzi scheme. Sudden large deposits, frequent large transactions, or an unusually high number of incoming wire transfers from different individuals could signal the presence of a fraudulent scheme.

- Customer risk assessment and know your business (KYB) procedures: Understanding the nature of their customers' businesses is crucial for financial institutions. By performing thorough risk assessments and KYB procedures, they can determine whether a customer's business operations and transactions align with their stated business model and industry norms. Any significant discrepancies could indicate a potential Ponzi scheme.

- Customer ID verification: Verification of customer identities is a crucial step in preventing Ponzi schemes. By confirming that customers are who they claim to be, financial institutions can help ensure that fraudsters cannot use false identities to perpetrate their schemes.

- Sanctions screening: Financial institutions also need to perform sanctions screening to verify whether potential or existing customers are on any international sanctions lists. This can help prevent transactions that would otherwise fund or facilitate Ponzi schemes.

- Reporting suspicious activity: If a financial institution suspects that a customer is operating a Ponzi scheme, it has a responsibility to report this suspicion to the relevant regulatory bodies. These reports can initiate investigations that may prevent the continuation of the scheme and protect potential victims.

By proactively implementing these measures, financial institutions can play a vital role in detecting and preventing Ponzi schemes. Their efforts contribute significantly to maintaining a safer, more transparent, and more ethical financial environment. However, the fight against Ponzi schemes is a collective effort, requiring the vigilance and participation of all stakeholders, including regulators, financial institutions, and individual investors.

Fintech and anti-money laundering (AML) strategies against ponzi schemes

The rise of fintech – financial technology – and advanced anti-money laundering (AML) strategies have opened up new avenues for combating Ponzi schemes. By leveraging technology, financial institutions can more efficiently identify, prevent, and report potential fraudulent activities. Let's delve into how fintech and AML strategies can be applied against Ponzi schemes.

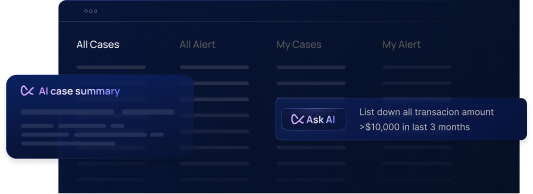

- Artificial intelligence and machine learning: AI and machine learning algorithms can analyze vast amounts of transaction data in real-time to detect unusual patterns or anomalies that could signal a Ponzi scheme. These technologies can learn from historical data, identify patterns associated with known fraudulent schemes, and raise alerts when similar patterns appear in new transactions.

- Blockchain technology: Blockchain technology provides a transparent, immutable record of all transactions conducted. This can make it harder for Ponzi schemes to operate, as any suspicious transactions would be publicly visible and could not be altered or erased.

- Advanced analytics: Through advanced data analytics, financial institutions can identify potential Ponzi schemes more efficiently. This can involve analyzing the behavior of customers and their transaction patterns, screening against known indicators of Ponzi schemes.

- Robust AML compliance programs: Fintech can assist in establishing robust AML compliance programs. Such programs can include automated know your customer (KYC) checks, transaction monitoring, risk assessment, and reporting processes. A strong AML program can help identify and prevent Ponzi schemes by spotting and addressing red flags early.

- Automated reporting: Fintech solutions can also streamline the reporting process. In case a Ponzi scheme is detected, automated systems can swiftly report it to regulatory bodies, ensuring a rapid response and minimizing potential damage.

- Information sharing: Fintech enables better information sharing among financial institutions and regulatory bodies. This cooperation can help identify and tackle Ponzi schemes more effectively by providing a broader view of potential fraudsters' activities across multiple institutions.

- Regulatory technology (Regtech): Regtech solutions can help financial institutions comply with regulatory requirements more efficiently and effectively. This includes obligations related to AML, such as monitoring transactions, conducting KYC checks, and reporting suspicious activity. By meeting these requirements, financial institutions can play their part in preventing Ponzi schemes.

Fintech and AML strategies provide valuable tools in the ongoing battle against Ponzi schemes. By harnessing these tools, financial institutions can better protect themselves and their customers from falling victim to such fraudulent schemes. Leveraging a trusted AML compliance solution demonstrates the power of technology to foster a safer, more transparent financial landscape.

Conclusion

In conclusion, understanding Ponzi schemes, their workings, their impact, and the strategies to combat them is crucial for any investor or financial institution. As we've seen, Ponzi schemes are complex and dangerous frauds that can lead to devastating financial losses and societal harm.

However, the battle against these schemes is not hopeless. As technology evolves and financial institutions become more adept at identifying and preventing such fraudulent activities, the landscape is gradually changing. Fintech and AML strategies are bringing about a revolution in the fight against Ponzi schemes and financial crimes in general.

Moreover, by adopting best practices in financial crime data management, as discussed in our previous article, financial institutions can enhance their ability to detect and prevent Ponzi schemes. It's a combination of vigilance, awareness, robust AML compliance, and cutting-edge technology that will turn the tide against these fraudulent schemes.

Remember, the fight against Ponzi schemes is a collective effort, and knowledge is your best defense. Stay informed, and continue to support the actions that make our financial world a safer place.

.svg)

%2520(1).webp)

.webp)