In the complex world of financial services, the invisible specter of financial crime looms larger than ever. The rapid pace of globalization and digital transformation has made the financial ecosystem vulnerable to various illicit activities, including money laundering, terrorist financing, fraud, and more. For financial institutions and businesses alike, understanding and complying with anti-money laundering (AML) practices isn't merely a matter of regulation—it's a critical component of corporate reputation and long-term survival.

Navigating the intricate maze of AML compliance can be challenging, particularly as businesses expand, cross borders, and delve into new market sectors. Amongst these complexities arises the role of a guardian of integrity: the anti-money laundering officer. An AML officer serves as the primary defense against financial crime, ensuring that organizations operate within the purview of established laws and regulations, and steering them clear from the reputational damage and punitive sanctions linked to non-compliance.

In this article, we aim to shed light on the intricate journey of AML compliance, placing particular emphasis on one pivotal question: When is the right time to hire an AML officer for your financial institution? Whether you're a nascent start-up, a company preparing to penetrate a heavily-regulated market, or an established organization aiming to fortify your compliance framework, this comprehensive guide serves to assist you in making an informed decision.

The rising importance of AML compliance

In the global financial landscape, three letters have become incredibly significant: AML, which stands for anti-money laundering. To appreciate the profound implications of AML and its importance in today's world, it's crucial to dissect what AML encompasses, its origins, its far-reaching impacts, and how it permeates various aspects of a company's operations.

AML refers to a set of procedures, laws, and regulations designed to prevent the illicit practice of generating income through actions and transactions that are designed to hide the true origin of these funds, a practice otherwise known as money laundering. The essence of AML is not merely about preventing illegal money from being cleaned through seemingly legal channels but also about safeguarding financial institutions from being unwittingly or deliberately used as conduits for such activities.

The origins of AML regulations trace back to the 1980s, with the formation of the financial action task force (FATF), established by the G7 countries to develop responses to curb money laundering. Over the years, the role of FATF has expanded beyond money laundering to include terror financing and other related threats to the integrity of the global financial system. Today, FATF's recommendations serve as the international standard for developing AML legislation.

These AML laws and regulations are not static but evolve continuously to address the changing tactics employed by criminals. The advent of digital currencies, for instance, has necessitated the incorporation of new rules addressing the potential use of these platforms for money laundering. Such evolving dynamics underline the importance of staying current with AML developments and underpin the significance of an AML officer's role within an organization.

Beyond adhering to legal and regulatory requirements, robust AML practices contribute significantly to a company's reputation and operational success. They signal to customers, investors, and the wider public that the company is committed to ethical practices and takes its role in safeguarding the financial ecosystem seriously. On the operational front, effective AML practices help organizations avoid punitive sanctions, including substantial fines and potential revocation of licenses, that could disrupt business operations.

Moreover, the proactive identification and mitigation of money laundering risks enable an organization to make strategic business decisions, whether it's entering new markets, introducing new products, or partnering with other entities. It's about protecting the company, its stakeholders, and the larger community from the damaging effects of financial crime.

In the forthcoming sections, we'll explore the practical implications of AML practices, particularly focusing on the role of an AML officer in an organization. We'll delve into the responsibilities and competencies of an AML officer, guiding you on when it might be the right time to consider appointing this crucial role within your company.

The responsibilities of an AML compliance officer

An AML officer, often referred to as a Compliance Officer, Money Laundering Reporting Officer (MLRO), or AML Compliance Officer, is tasked with the responsibility of implementing and managing an organization's AML compliance program. However, the role goes beyond just implementation; it encompasses understanding the intricacies of financial operations, staying abreast of evolving regulatory landscapes, and actively identifying and mitigating potential risks.

Designing and Implementing AML programs

The AML officer is primarily responsible for developing and implementing an organization's AML compliance program. This program, which should be tailored to an organization's specific operations and risk profile, includes policies, procedures, and controls designed to prevent and detect money laundering and other related illicit activities. The program often involves transaction monitoring systems, customer due diligence processes, risk assessments, training programs for employees, and mechanisms for reporting suspicious activities.

Regulatory awareness and compliance

AML officers must have a thorough understanding of relevant AML laws, regulations, and standards, both domestically and internationally, and ensure that the organization is in full compliance. This involves regularly reviewing and updating the organization's AML program to reflect changes in regulatory requirements and industry best practices.

Risk assessment

One of the core duties of an AML officer is to conduct regular risk assessments. This involves identifying the potential risks that the organization could face, such as the types of products or services it offers, the jurisdictions it operates in, and the nature of its customers. These risk assessments help tailor the AML program to address specific threats and vulnerabilities.

Suspicious activity monitoring and reporting

AML officers are responsible for overseeing the monitoring of transactions and customer activities for any signs of suspicious activity. If suspicious activity is detected, the AML officer has the responsibility of reporting it to the relevant authorities. The process often involves complex investigation procedures and detailed documentation.

Training and culture building

AML officers also play a critical role in fostering a strong compliance culture within the organization. They are often responsible for training employees about AML regulations and the organization's specific policies and procedures. They are expected to instill the understanding that everyone has a role to play in preventing money laundering and maintaining the organization's integrity.

Stakeholder communication

An AML officer often serves as the main point of contact between the organization and regulatory bodies, law enforcement agencies, auditors, and other external parties concerning AML matters. They are responsible for communicating the organization's AML policies and practices to these stakeholders and demonstrating the organization's commitment to compliance.

The role of an AML officer is undoubtedly challenging, given its breadth and depth. However, it is also rewarding as these individuals contribute significantly to preserving the organization's reputation, ensuring operational legality, and protecting the global financial system. Understanding these duties and responsibilities is crucial when considering the timing and need to onboard an AML officer in your organization, which will be the focus of our next discussion.

Amplifying the AML compliance culture

In the labyrinth of global finance, building a robust AML compliance culture is not just a regulatory necessity, but a cornerstone of sustainable business operations. This culture extends beyond a mere checklist of compliance tasks. It signifies a company's commitment to conduct business ethically and responsibly, and fosters an environment where regulatory compliance is interwoven into the fabric of daily operations.

The basis of an AML compliance culture lies in understanding the letter and spirit of AML laws and regulations. AML regulations vary across countries but are largely guided by the recommendations of the financial action task force (FATF), which sets international standards for combating money laundering and terrorist financing. These regulations typically require organizations to implement specific AML measures, including customer due diligence (CDD), transaction monitoring, reporting of suspicious activities, and appointing an AML officer.

Ensuring compliance with these regulations forms the backbone of an AML compliance culture, but achieving this necessitates a multilayered approach:

Education and training

Inculcating a culture of compliance begins with imparting the right knowledge. Regular training programs should be conducted to ensure that employees at all levels understand the importance of AML compliance, the specific AML practices to follow, and the potential risks of non-compliance. The training should be tailored to different roles and departments, considering their exposure to AML risks.

Leadership commitment

Top management's commitment is crucial in amplifying the AML compliance culture. Their active involvement and support can set the tone for the importance placed on compliance within the organization, ensuring resources are allocated to AML initiatives and reinforcing the notion that compliance is not optional, but integral to the company's success.

Policy development and implementation

Developing clear and comprehensive AML policies is a critical step in creating a compliance culture. These policies should cover all areas of AML compliance, from customer due diligence to transaction monitoring and reporting procedures. It is equally important to ensure these policies are effectively implemented and followed.

Risk-based approach

Organizations should adopt a risk-based approach to AML compliance, whereby resources and measures are allocated based on the level of risk. This involves regular risk assessments to identify areas of vulnerability and tailoring the AML program to address these risks.

Continuous monitoring and improvement

AML compliance is not a one-time effort but a continuous process. Regular audits and reviews should be conducted to assess the effectiveness of the AML program and identify areas for improvement. Feedback from these audits should be used to enhance the program and adapt to changing regulatory landscapes and risk scenarios.

Open communication and encouragement

Encouraging open communication can foster a strong compliance culture. Employees should feel comfortable reporting potential compliance issues and raising concerns without fear of retaliation. Moreover, recognising and rewarding compliance efforts can reinforce the importance of AML practices.

An amplified AML compliance culture reflects an organization's commitment to uphold the integrity of the global financial system. While an AML officer plays a crucial role in fostering this culture, the responsibility ultimately lies with every individual within the organization. In the next section, we'll discuss the strategic timing of appointing an AML officer in your company.

When to hire an AML officer

The decision to hire an AML officer can have a ripple effect, influencing not just an organization's regulatory adherence and financial stability, but also its overall market reputation, internal culture, and future growth trajectory. The timing for hiring an AML officer is not a universally predetermined milestone but depends on a spectrum of factors unique to each organization.

Regulatory requirements

Regulatory requirements serve as the compass guiding the financial sector, and it is paramount for an organization to recognize that certain jurisdictions may obligate the appointment of a dedicated AML officer once a company attains a certain size or volume of transactions. In such instances, the decision to hire an AML officer becomes a clear-cut path dictated by compliance necessities. However, it's crucial to note that AML regulations can significantly differ across countries and industries. For instance, entities such as banks, credit unions, insurance companies, and fintech firms are frequently required to have an AML officer in place due to the inherently high-risk nature of their operations concerning money laundering and associated crimes.

Complexity and scope of business

The complexity and scope of your business operations play a key role in shaping the decision of when to appoint an AML officer. Organizations with a footprint in multiple regions, particularly those with stringent AML norms, often need to appoint an AML officer early in their lifecycle. Simultaneously, if your organization caters to high-risk clients or offers products or services with increased susceptibility to financial crimes, hiring an AML officer becomes essential to effectively navigate and mitigate these unique risks.

Growth and scaling objectives

As an organization sets its sights on growth and expansion, the need for an AML officer becomes more acute. The amplification of operations, expansion into new markets, or product diversification inherently increases exposure to potential AML risks. Engaging an AML officer at this growth inflection point ensures that your organization scales responsibly, maintaining adherence to relevant AML regulations and norms, thus fortifying the foundation for sustainable growth.

Upholding and enhancing organizational reputation

A company's reputation, painstakingly built over time, is a valuable intangible asset that can quickly be undermined by an AML transgression. Organizations that place a premium on their market reputation and strive to project their unwavering commitment to ethical business practices often onboard an AML officer early in their business journey. This strategic appointment not only acts as a safeguard against potential regulatory pitfalls but also communicates a strong message to stakeholders about the company's dedication to maintaining global financial integrity.

Bolstering organizational capabilities

The role of an AML officer extends beyond the boundaries of ensuring regulatory compliance. They serve as a linchpin in strengthening an organization's internal capabilities pertaining to AML compliance. Through the dissemination of knowledge, cultivation of a compliance-oriented culture, and functioning as an expert resource on AML matters, they help the organization navigate the complex AML landscape more proficiently. The earlier an organization brings an AML officer on board, the quicker it can develop these essential internal capabilities.

To encapsulate, the decision to hire an AML officer is a significant strategic move. It should be meticulously planned, factoring in regulatory obligations, operational complexities, growth ambitions, reputational management, and capability enhancement needs. The appointment of an AML officer serves as a testament to an organization's dedication to fighting financial crime and ensuring the ethical conduct of business operations.

However, the appointment of an AML officer is just one part of a broader, ongoing AML compliance journey. As your organization grows, its AML needs will undoubtedly become more intricate and demanding.

Skills and competencies for an AML officer

An AML officer is the frontline defense against financial crimes, acting as a guiding light to navigate the treacherous terrain of money laundering and terrorist financing. But what exactly constitutes the skillset of a successful AML officer? Identifying the right fit for your organization involves understanding the comprehensive range of skills and competencies required for this critical role.

A solid grasp of regulatory knowledge

First and foremost, an AML officer must have an in-depth understanding of relevant regulatory norms, both at the national and international level. This includes the bank secrecy act (BSA), USA patriot act, EU fourth anti-money laundering directive, FATF Recommendations, and various other regulatory frameworks, depending on the jurisdiction(s) your organization operates in. They should also be able to interpret and implement new laws or changes to existing regulations swiftly and effectively.

Analytical and problem-solving skills

The realm of AML is rife with complex and intricate challenges. An AML officer must possess sharp analytical skills to identify potential risks and threats. They should be able to conduct thorough and meticulous investigations and be adept at interpreting complex financial data to spot inconsistencies and anomalies.

Risk management expertise

Understanding, assessing, and mitigating risks are key aspects of an AML officer's role. They need to be proficient in conducting risk assessments, developing risk profiles, implementing risk mitigation strategies, and constantly monitoring and adjusting these strategies as per changes in the business environment or regulatory landscape.

Excellent communication skills

An AML officer often serves as the bridge between the organization and regulatory authorities. They need to possess excellent written and oral communication skills, be capable of explaining complex issues in clear, concise terms, and present reports and findings to both internal and external stakeholders effectively.

Technological proficiency

In today's digital age, AML efforts are increasingly reliant on technology. A competent AML officer must be comfortable working with AML software and other fintech tools. They should understand how to leverage technology for efficient transaction monitoring, risk assessment, reporting, and more.

Strong ethical standards

Given their pivotal role in safeguarding the organization's integrity, an AML officer must have a strong ethical compass. They need to lead by example and promote a culture of compliance within the organization.

Continual learning

The world of AML is dynamic, with new threats emerging and regulations evolving constantly. An effective AML officer needs to be committed to continual learning, staying abreast of the latest developments, best practices, and emerging trends in the field.

Put simply, an AML officer requires a mix of technical knowledge, analytical abilities, communication skills, ethical standards, and a passion for continual learning. But identifying and recruiting such a resource is just one part of the challenge. Providing them with the right tools and resources to do their job effectively is equally critical.

The role of technology in AML compliance platforms

The world of finance, much like every other industry, is not immune to the transformative power of technology. In fact, technology has been a driving force in enhancing the effectiveness and efficiency of AML (anti-money laundering) compliance. While human acumen continues to be crucial in managing AML risks, modern AML compliance platforms have emerged as invaluable tools in fortifying an organization's defenses against financial crimes.

Automating compliance processes

The manual processes traditionally involved in AML compliance are time-consuming and prone to human error. Modern AML compliance platforms, powered by sophisticated algorithms and machine learning capabilities, automate many of these tasks, reducing the margin for error and freeing up human resources for more strategic work. These automated functions can include transaction monitoring, risk scoring, watchlist screening, and regulatory reporting, among others.

Enhanced transaction monitoring

AML compliance platforms can handle vast amounts of data and analyze it in real-time, enabling more comprehensive transaction monitoring. Advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) can sift through countless transactions in mere seconds, identifying potentially suspicious patterns that could indicate money laundering. This level of scrutiny would be practically impossible to achieve manually.

Robust risk assessment

Through the application of data analytics and AI, AML compliance platforms can undertake comprehensive risk assessments. They are capable of analyzing vast and varied data sources to create detailed risk profiles of customers, identifying high-risk individuals or transactions quickly and efficiently.

Streamlined reporting

Regulatory reporting is a critical element of AML compliance. Modern AML compliance platforms automate the reporting process, generating accurate and timely reports in line with regulatory requirements. This automated reporting not only reduces the burden on compliance teams but also ensures adherence to compliance timelines.

Adaptable to changing regulations

With regulations constantly evolving in response to new financial crime tactics, compliance platforms must be adaptable. Many AML compliance platforms are designed to be flexible, allowing for easy updates in response to changes in regulatory requirements. This ensures that the organization's AML strategy remains in step with current regulatory norms.

Fostering a culture of compliance

AML compliance platforms can also play a pivotal role in fostering a culture of compliance within an organization. They provide a centralized system that makes AML processes more transparent and accessible, encouraging all employees to take an active part in the organization's AML efforts.

In summary, AML compliance platforms have fundamentally reshaped the landscape of AML compliance, helping organizations navigate this complex field more effectively and efficiently.

Conclusion

The complex world of AML compliance requires more than human expertise; it demands advanced technology to effectively navigate its intricate landscape. While technology cannot replace the experience and judgment of skilled compliance officers, it provides powerful tools that enhance their capabilities. The key to a successful AML strategy lies in combining the right people with innovative financial crime compliance solutions, and that’s where Flagright stands out.

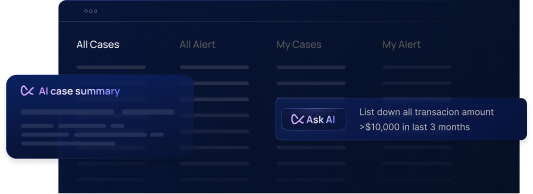

Flagright's real-time transaction monitoring gives businesses the power to track and assess every transaction as it happens. This unparalleled visibility allows organizations to spot potential AML risks promptly and take action to mitigate them. Alongside this, our customer risk assessment tools analyze customer data, highlighting any potential risks and ensuring the business stays ahead of threats.

In the realm of compliance, Flagright’s watchlist screening, KYB, Customer ID Verification, and risk scoring capabilities allow organizations to perform necessary checks swiftly and accurately. These features reduce the time and resources spent on manual checks, enabling teams to focus on more strategic tasks.

Notably, Flagright's AI-powered services deliver next-level efficiency. With our GPT-powered merchant monitoring and alerting feature, businesses can monitor significant changes in their customers' businesses across multiple public sources and social media channels in real time. This proactive approach drastically improves financial crime operations and eliminates manual monitoring efforts.

Our AI-driven platform also offers seamless integration with CRM tools like Salesforce, Zendesk, and HubSpot. This feature consolidates customer correspondence within the Flagright AML case management system, streamlining the investigative process and saving analysts up to 15% of their time each day.

Furthermore, Flagright's case and alert narrative generator and suspicious activity report (SAR) generator are prime examples of how AI can drastically improve efficiency. By automating recurring writing and communication tasks, we're able to save significant amounts of time while delivering high-quality outcomes. Our SAR generator, in particular, ensures consistent and accurate SARs, leaving no detail overlooked and reducing the risk of errors in manual SAR creation.

In essence, with Flagright, businesses can achieve comprehensive AML compliance by marrying human acumen with advanced technology. Our platform offers rapid integration from 3 to 10 days into your existing system, enabling you to kickstart your enhanced AML strategy promptly.

Are you ready to elevate your AML compliance strategy to the next level? Schedule a demo with us to experience firsthand how Flagright can revolutionize your AML compliance and fraud prevention efforts. Let's work together to create a more secure financial world.

.svg)

.webp)